Disclaimer: We are NOT affiliated with Symmetry Financial. This is merely our review of the their insurance sales and recruitment system along with our opinions. If you here hoping to get a hold of them, contact them directly at (877) 285-5402 or at sfglife.com.

Are you considering a career selling insurance with Symmetry Financial Group (SFG).

Perhaps you’ve interviewed or are thinking of scheduling an interview, and are researching more to get the truth about Symmetry Financial Group.

Even if you haven’t tested for your insurance license yet, if this describes you, you found the right article!

My job today is to answer your questions in this Symmetry Financial Group review in a fair and balanced analysis.

Let’s begin.

PS: Check out my insurance sales jobs reviews of other agencies for more information.

NOTE: Are you an aspiring or new insurance agent looking for more insight on how the insurance sales industry works? Check out my free New Insurance Agent Resource Guide to help answer many of your questions (as well as ones you didn’t know you had!).

Overview

About Symmetry Financial Group

Symmetry Financial Group is an insurance marketing organization based out of Swannanoa, North Carolina.

They work with a variety of insurance carriers like Mutual of Omaha, Foresters, Transamerica, and other name brand companies you may have heard of.

Inc. has ranked Symmetry Financial Group 4 years in a row among some of the fastest growing companies in the USA.

And Entrepreneur magazine voted Symmetry Financial Group is having a top company culture in 2017 and 2018.

Executive leadership of Symmetry Financial Group includes Brandon Allison, Brian Pope, and Casey Watkins.

Market Specialization

Symmetry specializes in several life insurance markets.

Chief among them is the mortgage protection insurance market.

What Is Mortgage Protection Insurance?

Mortgage protection insurance is a type of life insurance product targeted to new homeowners and folks who’ve recently refinanced.

They are interested in eliminating financial ruin coming from an earlier-than-expected death of a breadwinner.

From a marketing perspective, this is a perfect target market. Why?

People buying homes have just gone into debt!

And if a breadwinner passes away unexpectedly, that mortgage and lifestyle demands on income don’t die. They stick around!

The surviving family is left with the burden. And many families must foreclose on their properties without the ability to weather the financial storm.

This is why selling mortgage protection is such a great market.

You’re selling peace of mind and a safety net to growing families, helping them avoid long-term financial devastation if a loved one dies unexpectedly.

Face To Face

At Symmetry Financial Group, they teach agents to sell mortgage protection face to face with prospects who request information by mail.

You do not sell over the phone, but rely on old-fashioned belly-to-belly appointments to get to know your prospects to determine how you can best help them.

Educationally-Driven Sales

The best Symmetry Financial Group training has managers teach their agents to focus on educating their clients about their life insurance options.

And they do NOT teach them to be high pressure or pushy.

Selling life insurance is one of those businesses where people still value a face-to-face meeting in a large percentage.

And they look at the decision to buy life insurance with more concern than your typical consumer product.

The best strategy in mortgage protection sales is to act as an advisor to your prospects.

Be transparent fully with the options available.

Give your prospects the pros and the cons of your product. Then let them decide what works best.

Minor Markets

Beyond mortgage protection, SFG also offers agents the opportunity of selling final expense insurance.

“Final expense” is a marketing term to describe small-in-size whole life insurance policies.

Like all final expense companies, Symmetry targets older, fixed income individuals who have need for life insurance to cover funeral and cremation costs.

Benefits Of Selling Final Expense

The nice thing about selling final expense is that the pool of prospects is tremendous.

We’re talking hundreds of thousands within driving distance from your home.

And more prospects means it’s easier to generate final expense leads.

Since 2011, I’ve sold final expense face-to-face with prospects.

And what I discovered working right in the middle of the Great Recession is that final expense provides more consistent, stable sales opportunities.

Unlike mortgage protection which is subject to economic swings, final expense sales is stable.

Our clients receive a fixed Social Security check every month, and no market forces will alter that.

That translates into more lead-generating opportunity which is the cornerstone to most insurance sales professionals.

Why Work With Symmetry Financial Group?

While I can’t speak for all agents, there are several reasons why agents choose SFG over other opportunities.

First, Symmetry Financial Group has a well-designed platform for both agent development and agency development.

There are sales training and recruiting opportunities designed to bring in interested people and train them for your agency.

Symmetry also extols its incentive-based programs, which are based around additional bonuses for high personal production and agency production.

Is Symmetry Financial Group A MLM Scam Or Pyramid Scheme?

Let’s address this right up front.

Is Symmetry Financial Group legit?

Symmetry Financial Group is not an illegal operation.

In fact, Symmetry Financial Group is perfectly legitimate, run by experienced insurance professionals.

With that said, you do need additional insight on SFG’s multi-level marketing culture and hierarchy.

I’ll explain the differences now.

Multi-Level Marketing Structure

Symmetry operates in your usual multi-level marketing hierarchy that other large organizations like Herbalife, Mary Kay, etc do.

With insurance sales organizational design, at the top of the food chain is the insurance company, beneath them is Symmetry Financial Group, and beneath them is a large downline with agencies and agents.

This hierarchical structure on its own isn’t a bad thing.

Arguably, all corporations operate this way.

So, don’t let SFG’s business structure turn you off. In fact, hierarchical multi-level marketing structures are the norm in the insurance business.

My organization is designed the same way.

At the top are insurance companies, beneath them are large agencies who recruit agencies like mine, with other smaller agencies and agents beneath me.

MLM Culture

When all is said and done, what many have issue with in MLM-type companies is the “rah-rah, recruit, recruit!” culture.

Here’s how I mean.

Most insurance agencies focus more on recruiting than on agent skill development.

The insurance agency creates commission strategies that incentivize recruiting as the quickest and easiest way to elevate earning power through increased commission levels.

What’s the problem with this?

Because so many insurance MLMs are obsessed with recruiting, they follow the “spaghetti method” of recruiting.

Recruit anyone with a pulse and put them out there with little investment to do the same.

The good news is that it’s simple to determine if your organization is geared towards this model.

Simply ask for the commission contract grid to see how much recruiting is emphasized.

What’s Wrong With Recruiting?

There’s nothing wrong with recruiting insurance agents and building an agency.

It’s a legit business opportunity, and heck, I do it!

However, the problem is is that there is a time and a place for everything.

Before you recruit a single soul, you should know with intimate understanding how to sell whatever it is that you’re selling.

I believe that takes at minimum 6 to 12 months of successful experience selling insurance. I started recruiting at 2.5 years into the business.

And this is the problem.

Most MLM insurance companies have no readiness standards based on field sales experience.

They don’t care about whether or not you’re a proven producer and have the insight to teach others.

Instead, most organizations promote recruiting as equally important as selling, right from the beginning!.

Does this make sense to you?

It never did for me.

Think about it. Why would ANY new agent feel comfortable recruiting and training another agent?

Here’s the thing…

Certain organizations within Symmetry Financial Group are geared towards this concept, while others are more geared towards agent development.

I wish I could name names, but I cannot, as there are too many organizations to count.

Bottom line, you’ll have to complete your own due diligence.

Meet with leadership.

Discern the values of the organizations.

Talk with agents currently working with the organization.

If they talk recruiting just as heavily as selling, that’s your red flag =).

Symmetry Financial Group Cost Of Leads

Symmetry Financial Group offers both final expense leads and mortgage protection leads at different price points for new agents.

The “freshness” of the lead determines the start up cost of the lead to the agent.

In other words, how long ago the lead was developed determines its price.

The fresher the lead, the higher the cost Symmetry Financial Group charges.

Why? Because fresh insurance leads usually have more interest than older leads.

With that explanation, let’s break down the different levels of SFG leads.

A Leads

A Leads are the freshest type of life insurance leads SFG agents can purchase.

According to their Agent Handbook, A Leads are 21 days old or less, and have not been previously purchased by another agent.

Symmetry prices A Leads according to your agent contract level.

See the chart below to see the cost of leads depending various agent contract levels.

A Leads are exclusive to the agent for 5 weeks.

If no sale is made, other insurance agents at Symmetry Financial Group may purchase those A Leads at discounted cost.

Additionally, your SFG agency manager must approve any purchase of A Leads.

Standing A Lead Order

Symmetry Financial Group also offers standing lead orders.

This means you receive A Leads on a regular, recurring basis.

Your agency manager must sign off on you having access to recurring orders.

Also, Symmetry requires three pieces of submitted business before granting access to the program.

Overstock A Leads

These are unsold A Leads over 21 days old offered at the following prices:

-

- OA1: 21-60 days old = $12 a piece

-

- OA2: 61-90 days old = $10 a piece

-

- OA3: 91+ days old = $8

My opinion: overstock A Leads are are great value for the money.

If I were a new SFG agent, I’d hunt these leads down and buy all available to me to work, as the costs of overstock A Leads are very fair.

Bonus Leads

Bonus leads are leads available for resale.

These were once A Leads that another agent purchased and has ended the 5 week exclusivity period.

Age of leads determines the price point.

See below for details:

-

- 5A: previously distributed one time as an A lead, 5 weeks – 6 months old, $6.99

-

- 4A: previously distributed 1-3 times, 10 weeks – 12 months old, $5.99

-

- 3A: previously distributed 1-4 times, 15 weeks – 18 months old, $4.99

-

- 2A: previously distributed 1-5 times, 5 months – 24 months old, $3.99

-

- 1A: previously distributed up to 5 times, 8 months – 35 months old, $1.99

-

- 50C: previously distributed up to 6 times, 11 months – 50 months old, $0.50

Additional Start Up Costs

In addition to purchasing leads, joining Symmetry Financial Group will require you to pay for several start up costs, including:

Licensing and appointment fees

Before you can start working with Symmetry Financial Group, you’ll need to apply for resident and non-resident licenses and appointments, as well as take pre-licensing.

Licensing and appointment fees vary from state to state and range in the $200 to $300 cost. They also depend on whether you’re an individual agent or an agency.

For pre-licensing, expect to pay $50 to $150 for courses like ExamFX and XCEL Training.

You can get more information about licensing and appointment fees from the National Insurance Producer Registry.

Errors and omissions insurance

As an insurance agent, you’ll need errors and omissions (E&O) insurance, also called professional liability insurance. It helps cover the cost of a lawsuit if a client claims your work was inaccurate, late, or not delivered.

You can pay your E&O insurance up front for 12 months, or in monthly installments with most providers.

At EOForLess, sufficient coverage for most life insurance carriers runs approximately $460 for the year. If you opt for monthly payments, you must pay $140 down, and $35 a month thereafter.

Memberships and boot camps

After being appointed with Symmetry Financial Group, you may have some additional expenses, including various memberships as well as participating in the company’s events and boot camps. Some of these expenses are optional, others are not, depending on the type of product you are selling.

All About Compensation

I’m asked whether or not insurance agencies offer salaries to their new agents.

My answer is this:

In the vast majority of times, no.

Instead, selling insurance is an “eat what you kill business.”

Expect 100% of your earnings to come from insurance policy sales.

If you feel unease about this compensation structure, consider selling something other than insurance.

Starting Commissions with Symmetry Financial Group

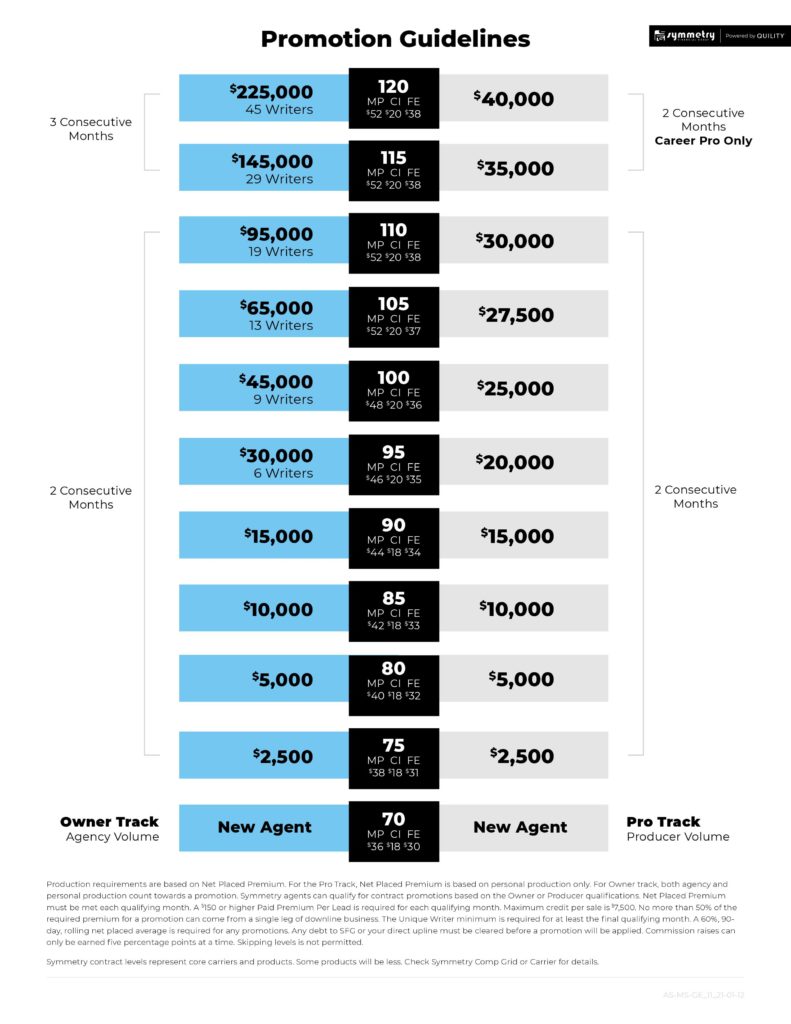

Like many large insurance marketing organizations, Symmetry Financial Group has a predefined compensation plan describing steps to increase commission levels.

You can refer to the commission structure plan below:

New agents to Symmetry Financial Group start at the SFG 70% contract level.

This means for select insurance products, you are paid 70% of the first year annual premium as commission.

Please note that many insurance products at the SFG 60% level pay less than 70%.

Download direct from SFG its commission grids here for more information.

Mathematical Example Of Commission Payouts

For example, if the annual premium of your new policy sale is $1,000, and your insurance product pays 60%, you earn $600 in commission.

Insurance carriers pay Symmetry Financial Group agents directly.

Opinions On Symmetry From Yours Truly

Now you have a basic understanding of Symmetry Financial Group, it’s time for me to insert my perspective.

A reminder…

My opinions come from the perspective of an experienced insurance agent and agency owner NOT affiliated with SFG in any way.

And remember. Let what fits your goals best guide you above all.

So let’s get started.

About David Duford

I’m sure it seems strange to visit an overview article on an agency and have the author describe his insurance sales background.

I assure you. There is good reason why.

And that reason is full transparency.

Transparency of motives and intentions is critical when considering any person’s opinion.

You want to avoid having a biased individual with his own motives at heart to try to influence your decision making.

That’s why it’s a good idea to learn a little about myself, so you more clearly understand my perspective and how I’ve derived my opinions of Symmetry Financial Group.

My Business

My name is David duford. I’m the owner of DavidDuford.com.

I help licensed agents become top producing insurance professionals.

In my agency, we specialize in several markets, including final expense, Medicare Advantage, annuities, and mortgage protection.

I received my insurance license in 2011 and focused on selling final expense life insurance.

By 2013, I opened my agency and began recruiting agents nationally that valued honest, integrity, and working with an agency who fully supported them.

I’ve talked to thousands of licensed agents since I began my career, and understand your concerns about finding and joining a quality insurance marketing organization.

My Experience

I like you started in the same position.

While excited about the proposition of selling insurance, I wanted assurances that my selected agency was legitimate and would serve my best interests in selling insurance successfully.

Like many agents who deal with inadequate marketing organizations, I jumped from agency to agency in the early years, thanks to never-kept promises.

Eventually I found a solid organization and have partnered with them to build my agency for many years now.

Point is this…

My perspective comes from my personal experience as a producer.

I know what it’s like to find an agency and be let down.

And what I’ve learned is that with enough due diligence, you can reduce your insurance career misfires.

Am I Biased?

Perhaps!

Let me explain…

Yes, I do recruit agents nationally into my agency.

That makes me a direct competitor to SFG.

So… why believe anything I’m saying?

What I’ve discovered about running an agency and providing useful insurance sales training content on YouTube is that giving without expectation is a powerful force for good that lifts all boats.

And from years of executing on this principle, I have built a reputation as a fair and balanced individual that cares for all agents.

Any deviation from this principle is against my code of ethics.

So let me say right up front…

Symmetry Financial Group is NOT a bad company.

In fact, countless stories of agents exist who have succeeded wildly within the Symmetry Financial Group system that’d say otherwise.

No Perfect Solutions

However, as with all things in life, there are no “perfect opportunities” fitting every need of every insurance agent.

As an agency owner, I’ve discovered that we do our best when we develop a “best-fit” profile that works well within the organization.

Agencies who have smartly developed a best-fit profile have higher agent success and retention because they know who is and who isn’t a good fit.

And just as much, YOU need to have a profile of what you want you you’re looking out of an agency.

Why?

Because as you’ll discover shortly, most agencies do not have profiles of success and follow a recruiting strategy that focuses on mass numbers, not selectivity and quality.

More on that later.

Recruiting Over Producing

My perception of Symmetry Financial Group is that some organizations focus more on recruiting than on training new agents become master insurance salespeople.

While this is not always the case with every affiliated SFG agency, you need to understand this possibility prior to joining, and decide how much of an impact it will make.

Having talked to thousands of insurance agents over the years, I’ve learned many organizations that focus on recruiting poorly execute on agent skill development.

Did you know over 90% of insurance agents leave the business in their first year?

Why?

One big reason is because agents aren’t properly trained for consistent sales success.

They don’t have an “in-the-trenches” mentor helping them become better and keep them accountable.

What’s the takeaway here? Do your due diligence!

Figure out if the SFG organization you’re considering joining values training you over recruiting.

I believe a focus on learning how to sell insurance successfully gives new agents the best chance of long-term success in this wonderful business.

Commission Concerns

While Symmetry Financial Group is transparent regarding commissions and advancement opportunities, it’s important that you compare commission offers with any organization.

When describing their income-earning opportunity, many organizations draw your attention to the raw dollar amounts you’ll make.

And sometimes leadership purposely uses over-the-top case size averages to make commission look better than it really is.

How Do Symmetry Financial Group Commission Levels Compare To Other Insurance Agencies?

Based on my research, Symmetry Financial Group is on the lower end of starting commission levels.

I’ve researched some organizations like Equis who start agents at slightly higher commission levels.

For the sake of comparison, I start final expense and mortgage protection agents between 100% to 110% commission contracts (yes, you are actually paid more than first year premium collected).

Plus there’s room for commission growth with experience.

You may wonder how I’m able to offer such higher commission levels.

The reason why is because I do not have multiple downline agencies and agents between myself and you.

In a typical insurance MLM, there are 6 to 12 people between you and the MLM.

ALL of those people earn a commission on each sale.

And while I’m not against making money, you do have to ask yourself…

“Do these 6 to 12 people EARN the commission override I pay them from my sales?”

For me, the answer is NO.

That’s why I designed my agency with a smaller hierarchy than typical insurance MLMs.

This means more commissions to my producing agents, meaning a better opportunity to maximize income.

Bottom line, commission levels are seriously important.

Remember, you’re running a business. This just isn’t simply a commission sales job.

You must factor in the Symmetry Financial Group’s start up cost of doing business, making sure that you’re covering costs AND profiting handsomely to justify your effort.

Let’s do the math.

Let’s say you think I’m “biased” or FOS.

Fine. So let’s take a look at the math.

Numbers don’t lie!

If you write $200,000 in annual premium for the year at a 60% contract, your gross revenue is $120,000.

While I can’t say with precision, you’re likely taking A Leads to produce this volume, meaning your lead cost for the year while average between $30,000 and $40,000.

$120,000 minus $30,000 equals $90,000 in net income.

Now let’s compare net earnings on a 60% contract to a 100% contract.

Let’s say an agent earns an average of 100% on his insurance sales commission.

And let’s use the same premium written as before.

If an agent writes $200,000 in annual premium at a 100% contract, his gross revenue is $200,000.

And while this isn’t always the case, let’s say lead costs are higher at $50,000 for the year.

$200,000 minus $50,000 equals a $150,000 net income.

That’s a $60,000 annual difference in your earning power… EVEN when lead costs are higher!

Symmetry Financial Group Training – Isn’t That Important?

This is a worthwhile objection many marketing organizations bring up when an agent expresses concern about commission levels.

They say looking at commission in a vacuum is not valid, and agents should consider the whole package, meaning training, recruiting opportunities, lead programs, etc.

I agree with this sentiment.

If all you consider is commission level, you’re doing yourself a disservice.

Agents need a SYSTEM of success.

And even if you have less commission upside with an organization that grants you access to their system versus one that doesn’t, it’s possible the lower commission organization offers you a better deal.

So when looking at SFG or any insurance sales organization, always consider the full package.

Do an inventory on what matters most to you to determine your best-fit insurance sales opportunity.

How To Quit Symmetry

There are many reasons you may want to quit Symmetry, for example, you ran out of money to invest in leads, you ran out of prospects to sell to, or you simply found that the business of selling insurance wasn’t a good fit for you.

The good news is, quitting Symmetry is easy.

Here’s how to do it.

First, start by doing your due diligence and find another insurance agency to work for. We recommend you review our Free Agent Resource Guide here for tips on finding a quality insurance agency to join.

Once you find a new agency or carrier to join, you can go ahead and switch your affiliations.

You should keep in mind that as an insurance agent, you are licensed by the state and not by the company. No insurance agency can prevent you from stopping your affiliation with it and doing business with another organization.

You may need to cancel the affiliation with Symmetry. The termination usually needs to be filed within a 30 day window, however canceling affiliation is not always mandatory.

To become properly appointed with the new insurance carrier or agency, you simply complete contracting with the new insurance carrier.

Typically, the window for companies to process affiliations is very short, with most companies approving insurance agent carrier appointments within 1 to 2 weeks on average.

Bottom line, quitting Symmetry is no big deal. Simply find another organization that’s better suited to your insurance sales career goals, submit contracting through the new organization, and within the next few weeks, you’re good to go and can stop doing business with Symmetry.

Companies Like Symmetry

Let’s take a look at some insurance agencies and companies similar to Symmetry in case you’re interested in doing a comparison.

Bankers Life

Bankers Life was established in 1879 in Chicago, Illinois. The company is a subsidiary of CNO Financial Group.

Bankers Life offers life insurance, long-term care, annuities, Medicare (Supplements, Advantage Plans, Part D prescription drug coverage), critical illness insurance, as well as vision and dental plans. It targets the senior market, typically people age 60 and older who are near retirement.

People Helping People (PHP)

People Helping People was established in 2009 in Northridge, California. The company serves the middle markets for insurance-based financial planning. It focuses on term insurance, index universal life insurance, and fixed indexed annuities.

American Income Life (AIL)

American Income Life, a wholly owned subsidiary of Globe Life Insurance, is a major provider of supplemental life insurance. The company was founded in 1951 and is headquartered in Waco, Texas.

American Income Life’s core markets are labor unions, credit unions, and associations for insurance solicitation. Its insurance products include life insurance and supplemental health.

New York Life

New York Life, established in 1845, is the largest mutual life insurance company in the country. It offers premium life insurance, long-term care insurance, retirement income insurance, and investment plans, including annuities, mutual funds, and ETF saving plans.

USHEALTH Advisors

USHEALTH Advisors is a wholly-owned national sales and distribution subsidiary of USHEALTH Group, one of the largest employers of health insurance agents in the United States.

USHEALTH offers individual health coverage plans and a number of related supplementary products. It specializes in marketing innovative and affordable health coverage plans. The company is focused on providing healthcare solutions to individuals and families, as well as self-employed and small business owners.

Equis

Equis is a marketing organization for independent insurance agents and agency builders.

Its main product is mortgage protection life insurance, designed to reduce or eliminate the threat of foreclosure or eviction if the insured passes unexpectedly. The company also offers final expense, living benefits, and indexed universal life insurance products.

Freedom Equity Group

Freedom Equity Group, based in Arroyo Grande, California, is an independent marketing organization (IMO) that contracts with insurance companies to promote and distribute a range of life insurance products.

Freedom Equity Group focuses on selling life insurance and annuities. Its main product is indexed universal life insurance, a form of permanent coverage that provides a cash value in addition to life insurance.

Summary And More Resources

I hope this article provides a fair and balanced perspective on Symmetry Financial Group, and whether or not SFG makes sense for your career goals.

I’ve included more resources below to help your due diligence efforts.

Lastly, feel free to leave a comment below if you have questions. I’m happy to answer.

Or you can reach out to me here.

Resources

-

- Here are Symmetry Financial Group reviews at Glassdoor, as well as agent insight on the SFG opportunity at the Insurance Forums.

January 03, 2023

January 03, 2023

January 03, 2023