Thinking about getting into selling insurance?

Are you worried that selling insurance is hard?

In this article, I’m going to have a little heart to heart with on why selling insurance is so damn hard.

I’m writing this especially for those of you that are:

Struggling in the insurance business right now, or, thinking about getting your insurance license, and are having doubts if this industry is right for you.

My goal is for you to determine whether or not this business is right for you.

Quick link navigation for this article:

1. Why Insurance Sales Is Hard – Most Agents Fail

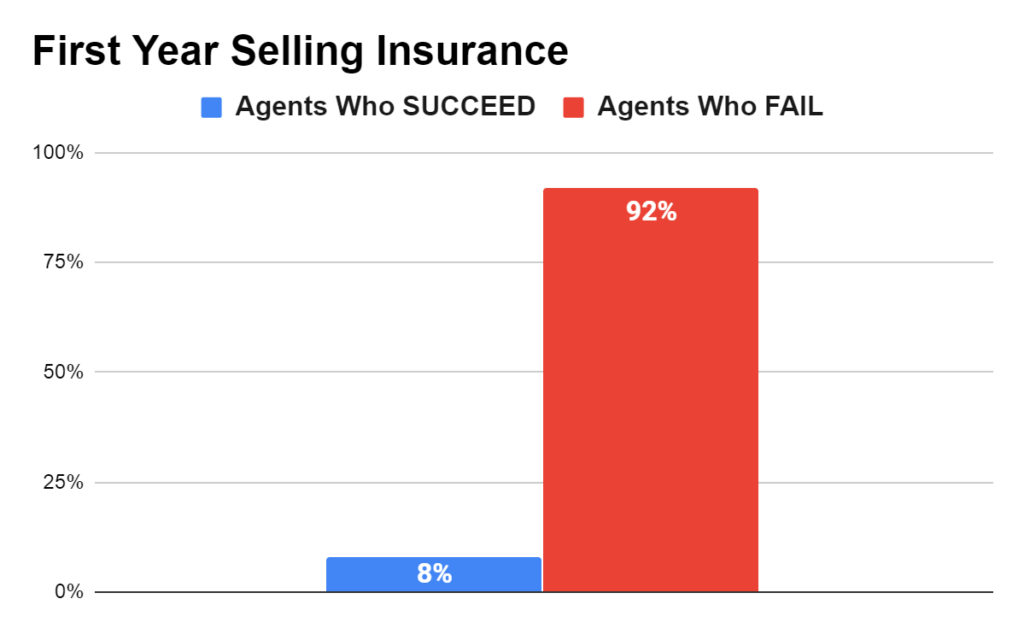

You might’ve heard these numbers before…

90%, 92%, 98%.

These numbers refer to the percentage agents that fail out of this business in their first year.

Have you ever heard of a job where nine out of 10 people quit or fail? Crazy, right?

Well, that is the essence of selling insurance, no matter what kind of insurance you sell.

Why do people fail at such a high rate?

There’s a few reasons why. And I want to reveal what they are so you can develop a plan to avoid failure.

2. Why Insurance Sales Is Hard – Commission Based Pay

First big thing…

Unlike jobs with a predictable wage, insurance paychecks are 100% commission based.

That means you eat what you kill, ladies and gentlemen.

Ain’t nobody’s responsible for paying you a dime if you don’t produce.

In fact, odds are you’ve earned a wage and never worried if the work you do actually provides value.

Not anymore in insurance sales!

3. Why Insurance Sales Is Hard – The Buck Stops With You

It’s entirely up to you to earn your money, and you won’t be paid if you don’t sell new policies.

That reality brings a host of problems and emotional stress many cannot manage.

Think about it. Every day, you start at zero with nothing. And there are no guarantees you’ll make any sales.

On straight commission, paying basic bills is in question. If you don’t make new policy sales:

-

- How are you going to make your mortgage payments?

-

- How are you going to take care of your kids?

-

- Send them to the schools you want to send them to?

-

- Or go on vacations?

This stress magnifies in intensity over time.

Most agents “lose that fire in the belly,” that enthusiasm necessary for success as they realize they face these realities.

How do you overcome this issue?

4. Why Insurance Sales Is Hard – Mindset Is Everything

MUST have the right mindset from the beginning.

In fact, everything being up to you is a good thing.

For those of you who are high-achievers in life, this should super excite you.

You know you have to go out there and apply yourself to the maximum to have a shot an earning a great income.

Of course, we all get a little discouraged when things don’t go right. That’s normal.

Burn The Bridges

Back in my early days, I’d say, “Join an insurance agency that pays you a salary, or a retainer, or a draw, or something like that.”

But that’s not how I think anymore.

Here’s the truth…

If you can’t swallow the fact that it is up to you entirely to make a living and you are paid on performance, do not sell insurance!

5. Why Insurance Sales Is Hard – Psychological Toll

You cannot fully control the outcome of each sale.

The paradox of insurance sales is that the successful insurance agent will be:

-

- yelled at,

-

- screamed at,

-

- told to go to hell,

-

- “No, I’m not buying”,

-

- “I need to pray about it”, or

-

- “talk to my pet rock,”

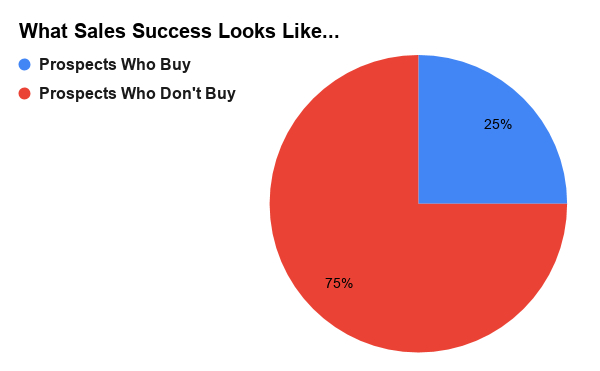

75% of time they’ll hear this.

The crazy thing?

That 25% who DO buy is what drives your success.

In fact, if only 1 out of 4 of your leads buys, you’re likely on your way to a six figure income selling products like:

-

- Medicare Advantage, and

Get Used To Hearing “NO!”

Most of the time you’re going to have people tell you “No”.

Do you understand psychologically what it’s like to hear no all the time?

If you’ve never sold anything before, you won’t understand it.

It takes some getting used to, because at first you’re thinking,

“Well, they think I suck, they don’t like me. They think my product stinks, or they think I stink.”

It’s not personal. People have their issues, and not everybody’s a lead or a buyer.

6. Why Insurance Sales Is Hard – It’s A Numbers Game

BUT… it’s easy to take it personal and not keep going. And THAT is where the problem lies.

Insurance sales is a numbers game!

Again, hearing people say no seems like they are rejecting YOU, but they aren’t really.

They’re rejecting your offer, which is different than rejecting you.

Still, rejection in any form can be demoralizing.

That coupled together with not making any money when you’re out working prospects can cause stress at home, cause stress on the financials, and just be an overall issue.

How To Defeat The Emotional Toll Of Selling Insurance

How do you handle the psychological stress of it all?

First, let me say there is hope here.

It’s all about developing a mentality towards controlling the process, as opposed to controlling the outcome.

I learned this from an agent I interviewed named Nick Frumkin.

He taught me that the only thing you CAN control is the inputs, you can’t control the outputs, which is your sales results.

But you can control the number of people you talk to, the number of presentations that you get on a daily basis.

Bottom line: You CAN control your activity.

And THAT’s only way that you can get a more predictable outcome (closed insurance policies).

Now that doesn’t mean you’re going to know with each presentation what you’re going to get out of the sale.

You won’t.

There is a sense of randomness to it, even if we perform a perfectly executed insurance sales presentation.

The solution instead is that you control your activity and the inputs.

Having a mindset obsessed with the inputs and the process is THE way that you can actually control and manage the outcome, which is your income.

7. Why Insurance Sales Is Hard – Weight Of Responsibility

Probably the biggest reason why people fail out of this business and why this business is so hard is this…

Everything is ultimately your responsibility.

The buck stops with you. You are responsible for your outcomes in your business.

You’re responsible for the inputs that you put in.

If you can’t manage that? You’ll end up getting a job working for someone else, making them rich.

There are no other alternatives here, there are no other solutions.

You’re in a position where you own your own successes and failures. And what you do with either is your decision.

Failures Avoid Responsibility

In the insurance business, people fail because they don’t own it. They blame things like:

-

- commissions,

-

- their up line, etc.

They make themselves victims, sacrificing their own personal power to avoid the pain of accepting full responsibility.

Don’t become a victim. That’s how a lot of people fail in life and in insurance sales.

Having the right mentality can mean the difference between being stuck in a job you hate and never advancing, or going somewhere and being your own boss.

The insurance business requires ownership of your circumstances, good and bad.

Progress Will Come

And once you own and embrace them, you will see progress.

You will see the ability to move on beyond yourself and start to experience success.

Own your problems. We all have shortcomings, challenges, and frustrations. But you have to own the setbacks to move forward.

Approach the difficult stuff as a lesson. What are the frustrations, challenges, and issues trying to teach me? What can I gain from this to improve?

That’s the mindset you need to have to get through the tough times.

8. Why Insurance Sales Is Hard – You Have To Embrace The Parts That Suck

Last but not least, you have to embrace the parts of this business that suck.

Selling insurance comes with this host of opportunities and problems.

Look. There are no perfect business models in any industry.

Every business model has a collection of good and bad, and you must accept both for success.

Sober Up On That Kool-Aid

A lot of people are brought into this business selling blue sky, getting drunk on the Kool-Aid, and then they hit a wall when they realize people don’t want to buy their stuff.

Not only do they not want to buy, they think insurance salespeople are bad people, and they don’t want to talk to you.

They’ll insult you and cuss at you.

This is the stuff that you’re going to experience and you must embrace it, why?

Because those that don’t deal with it thin the herd, taking out your competition.

Thank Goodness It’s Tough!

If you have the mindset of thanking the Lord for the suck, for taking the competition out and keeping you in because you are the fittest in the jungle of insurance sales, you’re going to benefit from this natural process of survival of the fittest.

Think about it… if everybody got in this industry and everybody was successful, guess what?

We’d all be making six bucks an hour and no one would make any real money.

The difficulties in this business will never go away. But they DO get more manageable.

The secret to success in this business, and overcoming the difficulty, is accepting the realities of it.

9. Why Insurance Sales Is Hard – You Have To Master Yourself To Master Insurance Sales

You have to learn to overcome not just the issues in this business, but yourself.

Mastery of self is how you have mastery in insurance sales. Learning to control your emotions and control your frustrations.

Don’t let the worser half of you talk you out of this business, “Oh, there’s some other silver bullet over the hill, some other grassy knoll.”

The grass is always greener, all that stuff. You got to embrace everything, take responsibility and go all in.

It ain’t going to get any easier, it just gets… more manageable.

This is what makes this business very lucrative for those of you who stick around.

Looking For A Quality Final Expense IMO To Partner With?

To learn more about contracting with my national agency, reach out here.

We have access to all sorts of benefits for final expense agents, including:

-

- Top contracts with the best final expense carriers for new and experienced agents. David Duford recruits and operates at FMO/IMO levels, giving him buying power to offer commission levels to agents and agencies others cannot match.

-

- Affordably-priced, high-quality lead programs for direct mail, Facebook, and telemarketing leads. David does not profit from the sale of leads, only referring you to sources with a track record of success.

-

- An endless supply of top-notch prospecting and sales training at your fingertips.

-

- Weekly sales training calls with David, ride-along training opportunities with David and his team, and direct phone/text access to David when you have case placement and sales questions (yes, David answers his own phone =).

-

- Additional training and support for agents interested in cross-selling Medicare Advantage, annuities, or growing their own insurance agency.

-

- Check out David’s Agent Success Stories here for more insight.

Reach out to David by starting here. Talk soon!

January 03, 2023

January 03, 2023

January 03, 2023