Need insurance leads?

You’ve found the right website =).

In this article, I do a deep-dive on all-things about the best insurance sales leads.

We’ll explore the top prospecting methods (paid and free) and how to generate insurance leads that close!

My goal is to help both agents new and thinking about getting an insurance license, as well as experienced agents selling insurance, to get the facts on insurance lead generation strategies.

Bottom line, you NEED to know what type of insurance sales leads ACTUALLY work in the real world.

It doesn’t matter what insurance product you sell…

Or ANY product…

My article WILL help you sort through and find the BEST life insurance lead generation strategies ALREADY proven successful.

Let’s begin!

Article Quick Navigation Links

- Best Types Of Insurance Leads

Direct Mail

Direct mail is good old fashioned “junk mail” we all receive.

In many insurance niches, direct mail is a critical and reliable source for new leads for insurance.

More Engagement

And what makes direct mail great is in its natural ability to get prospects involved.

Here’s how I mean…

First, your prospect reads the insurance lead.

Next, she talks with her spouse about the offer.

FINALLY… and only IF they agree, the prospect calls or mails back the card for more information.

Better Than Most Leads

Think about it.

NOBODY forced these clients to do NOTHING! =)

By their own volition, they WILLINGLY asked for solicitation.

Don’t you think that this level of willful engagement translates into a BETTER quality insurance lead?

Hopefully you agree!

High levels of voluntary engagement in insurance lead generation campaigns are ESPECIALLY effective, since most modern lead generation is point-and-click with little to no involvement.

Scalable, Too

And another HUGE benefit of direct mail is its scalability.

You can start your direct mail lead flow on a small basis, then scale up accordingly to your income goals.

For example, many new agents in my agency start with 20 direct mail leads weekly.

As they develop their flow, they easily scale lead flow higher.

In fact, I have multiple agents taking 50 to 80 direct mail leads weekly making a solid six-figure income from insurance policy sales.

One last year I profiled on my Success Story page wrote $500,000 in final expense business using direct mail leads.

3 Types Of Direct Mail Leads

Regardless of your insurance specialization, you can classify direct mail insurance leads into 3 categories.

Which category each lead fits into depends on the lead copy specificity and the clarity of the offer.

What I have discovered is this…

ALL of the following direct mail marketing strategies WORK!

However… the key is to find the strategy that works best for YOU.

For example, some agents do well with one lead yet poorly with another.

Your job is to test different types insurance marketing leads strategies.

For most, it takes time to find the perfect fit.

Here are the 3 direct mail insurance lead categories:

-

- Generic

-

- Specific

-

- “Bribe” Card

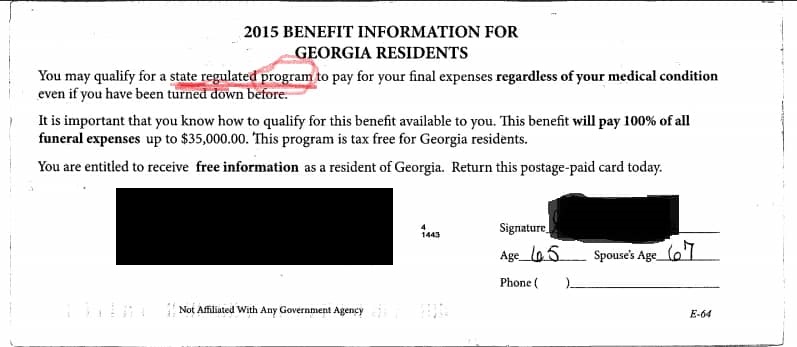

Generic Lead Card

Out of the 3 types of direct mail leads, generic lead pieces are the least specific.

In fact, when you read them, you’ll notice the lead piece says very little (if anything) about your insurance product.

At worst, the lead copy is confusing, leaving much to the imagination.

However, curiosity kills the cat, as they say.

Saying little instead of more sparks enough interest to send back the mailer.

Good generic direct mail cards imply or hint at offering a special deal without spelling out the specifics.

Benefit Of Generic Insurance Mailers

The benefit to these leads are higher-than-average response rates, thus more leads to talk to.

Here’s a sample generic lead we use in final expense.

Notice how there is no direct mention of life insurance.

Our final expense agents will get a higher response with this card than other, more specific leads.

Why Use A Non-Specific Insurance Marketing Strategy?

If you’ve never used this style of insurance lead before, you’re probably asking:

“Why would I want to use a lead card like that isn’t specific?”

Here’s why…

Higher Potential For More Appointments

Many of the best agents are ONLY concerned with booking an appointment.

In fact, they want as many face-to-face appointments as humanly possible.

And what these highly-productive agents do from there is build trust and rapport.

That’s all the need to sniff out opportunities for one or multiple insurance sales opportunities.

Higher Response Rate

You receive higher response back because people are simultaneously confused yet curious enough to send the card back for more details.

Where inexperienced agents have difficulty with generic leads is setting the appointment.

For example, in final expense sales, many agents utilize this generic style of card.

Less Is More

The lead card’s sales copy does not say “life insurance.”

Instead, it uses words that IMPLY life insurance.

Inadvertently, a percentage of prospects send back the lead, thinking it’s some new government program to get insurance for their burial.

While it’s important not to mislead your prospect, saying less is more in this case.

Too MUCH specificity may shut down the conversation prematurely, eliminating the appointment-setting opportunity.

Running Your Presentations With Non-Specific Leads

At the sales presentation, it takes a different strategy to progress the sales call.

Expect more incorrect presumptions from prospects than with specific leads.

Understand that this is OK, as you’re fact-finding for sales, while winning the client’s trust.

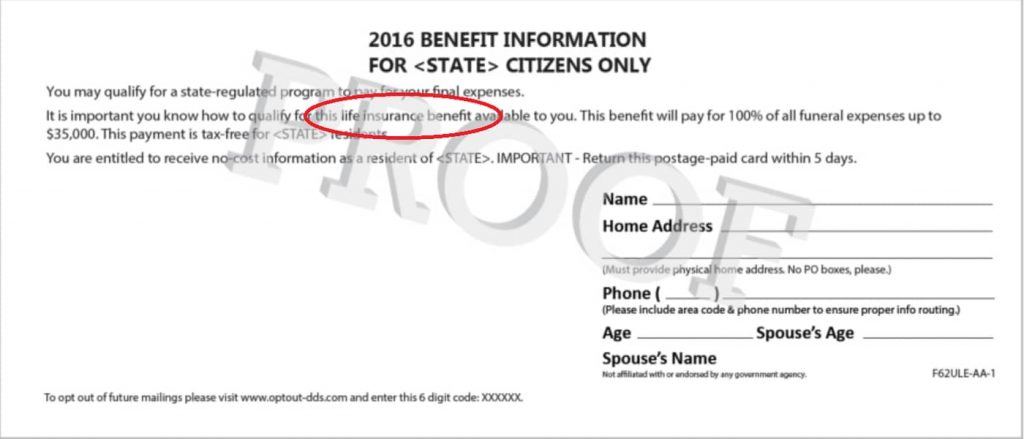

Specific Lead Card

My preference for new insurance agents is to use direct mail with more specific language.

As opposed to generic lead cards, specific lead cards describe EXACT features and benefits.

As you can imagine, a specific lead card strategy on par generates better-qualified insurance leads.

See the insurance mailer below for an example of what a specific lead looks like.

Notice that the lead actually says “life insurance.”

More Specificity = Lower Response Rate

However, with more specificity comes a drop in response rate.

More specificity equals less confusion, which results in less curiosity to send back the card.

Naturally, the outcome rests solely upon the insurance agent, and how well he executes his sales strategy.

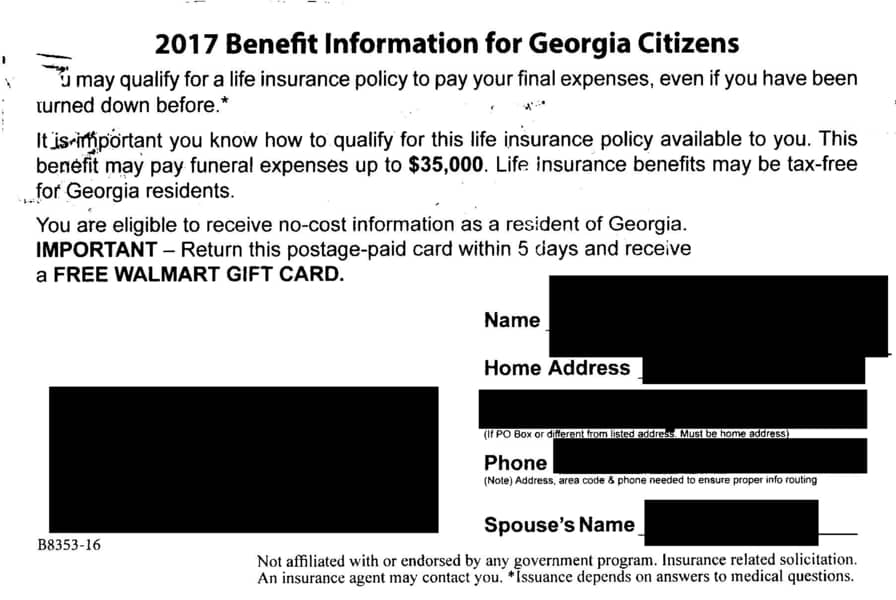

Bribe Lead Card

Bribe card leads direct mail solicitations that encourage response through a free giveaway.

In final expense sales, there are multiple bribe card designs with track records of success.

The most popular bribes include offering a free Memorial Guide, a free last will and testament, or a Walmart gift card.

Here’s an example of my favorite bribe lead card I use when selling final expense:

Freebies Increase Response Rates

Giving something away regardless of lead type boost response rates.

However, you’ll deal with prospects only wanting the free gift, NOT the insurance solicitation.

Much depends on what you, the agent, do with that kind of opportunity.

Different Strokes For Different Folks

Understand different lead strategies attract different kinds of prospects.

And if these prospects frustrate you – or the strategy itself doesn’t sit right with you – consider a different lead route.

Do you think working with people who want something for free is annoying?

Then using bribe leads ain’t so smart. =)

A mindset mired in frustration versus opportunity reduces your effectiveness.

And that’s reason enough to try a different lead strategy.

Direct Mail Insurance Lead Vendor List

Below are a list of direct mail lead vendors I have used in the past.

All offer a variety of high-quality direct mail insurance leads for various product lines:

Need-A-Lead: They offer fixed price direct mail final expense leads, Medicare Supplement leads, Medicare Advantage leads, and annuity leads.

![]()

Lead Concepts: Lead Concepts offers the bribe card mailers seen above. Also offers Medicare leads and annuity leads.

JenMarco: Offers low-cost insurance sales leads, typically lower than most.

Lead Heroes: Lead heroes now offers direct mail insurance lead solutions to both agents and agencies.

Telemarketing

Along with direct mail, telemarketing leads are one of those “old-school” prospecting methods many agents utilize.

However, with the advent of Do Not Call telephone solicitation rules, telemarketing’s effectiveness has dwindled.

A Dying Form Of Prospecting

For example, an insurance sales strategy focusing on residences rarely works utilizing telemarketing leads.

Why?

Because the government only allows telemarketing to households that:

-

- Have a land line, and

-

- Are not on the Do Not Call list.

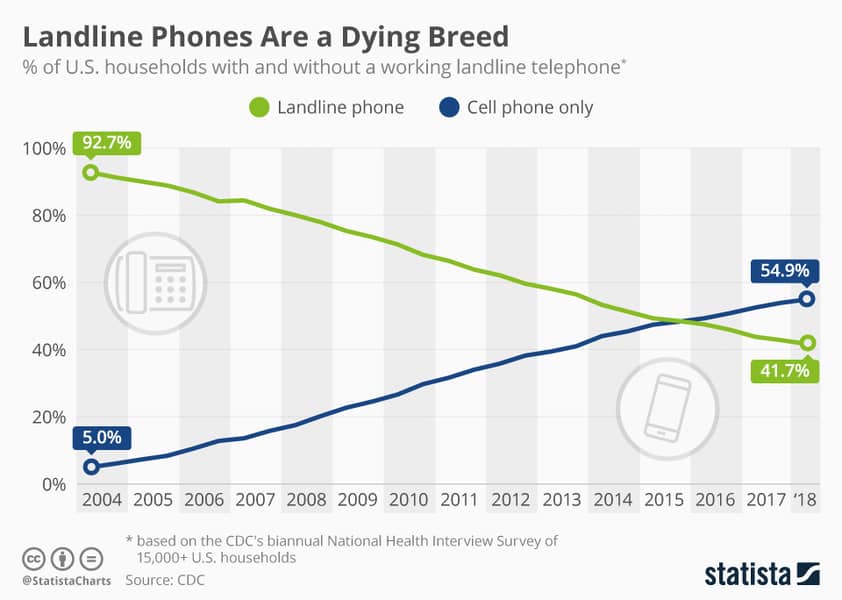

Further, only 41% of the population has a landline.

And while I have no data to support my thoughts, my gut says that landline ownership consists of folks 60 and older, and those who live in Rural America with poor cell phone coverage.

That’s why residential telemarketing is only viable with the older population.

My Least-Favorite Prospecting Method

Out of ALL the insurance lead generation strategies mentioned…

Residential telemarketing for insurance sales receives my lowest grade.

Nevertheless, I DO know agents who work telemarketing insurance leads with consistent success.

I just talked with my agent Jason in Florida who wrote $6500AP last week.

Those are strong numbers for an agent using weaker leads.

As the saying goes,

“It’s the Indian, not the arrow.” =)

Options For Handling Telemarketing

Do It Yourself

Like all insurance lead methods, you can telemarket yourself without outsourcing.

And in many markets, this works extremely well.

First, effective telemarketing takes time. Think of it as “sweat equity.”

You must call dozens, even hundreds of names daily, with the goal of sifting through the chaff for the wheat.

Also, you MUST have a rock-solid cold calling script for the best results.

Outsourced

Alternatively, outsourcing telemarketing insurance leads works, too.

You can hire telemarketers locally, nationally, even internationally.

While hiring overseas telemarketers significantly reduces the average lead price relative to on-shored telemarketing, expect a reduction in quality insurance leads.

Language barriers, hard-to-understand accents, and colloquialisms unfamiliar to the callers will turn off some prospects that otherwise would have become an insurance lead.

Management Concerns

Also contemplate how much management you want to personally do.

While you may exact more control over the telemarketing insurance leads process, it comes with added responsibilities such as:

-

- Screening,

-

- Hiring,

-

- Training, and,

-

- Motivating.

Why are these a concern?

Because this may interrupt what matters most to all agents – your time in front of prospects.

Buy Direct From A Vendor

Don’t want to manage a telemarketing group?

Then consider buying insurance sales leads directly from a telemarketing insurance lead vendor.

In many insurance lines, there are vendors who will take a fixed price to generate leads for you.

This eliminates management responsibilities mentioned above.

Here’s the thing…

Understand most purchased telemarketing leads are probably non-compliant with telemarketing laws.

Many vendors do what’s called voicemail leads or robocall leads, which are explicitly a non-compliant insurance lead generation strategy.

Others do not adhere to the Do Not Call rules, and call all names with land lines.

Telemarketing Vendors

As far as trusted vendors, there are very few telemarketing insurance leads that I trust.

One I like is The Lead Jerk.

He’s always done a good job for agents in the final expense and Medicare side of things.

There’s also Lead Heroes, as well.

With that said, let’s discuss some telemarketing strategies that DO make sense, more so than the “shotgun method” most agents and vendors use.

Telemarketing Around Life Events

The perfect cold call telemarketing attempt focuses on targeting prospects experiencing a “life event.”

What you find with telemarketing around life events, your results improve.

In fact, people are more open-minded to seeing what you can do to help.

Example: Medicare

For example, virtually all seniors start Medicare when turning 65.

And most are open-minded enough to consider picking up a Medicare Supplement or Medicare Advantage plan to compliment their new Medicare coverage.

Telemarketing New Businesses

Do you target business owners?

If so, consider telemarketing for new business insurance leads.

New businesses are in a buying mode. They are forking over money for marketing and materials.

And helping these business owners navigate topics like employee insurance concerns is of high interest to them.

Where To Find?

Where do you find new businesses?

Read your local online newspaper.

You’ll see new business announcements several times a week.

Many list new business licenses issues, along with an address and telephone number.

TV Leads

We’ve all seen the commercials during Steve Harvey or Wheel of Fortune that advertise burial or Medicare insurance coverage.

If Grandma calls that number, a “fronter” pre-qualifies the lead transferring her to a licensed insurance agent.

My experience is that TV insurance leads are very effective, but you need to commit to large geographical areas for the campaigns to make sense.

And many times this puts these styles of leads out of reach for individual agents.

Most commonly, small to large call centers are big buyers of TV-generated insurance leads, as they can work any state they are licensed in.

TV Lead Vendors

Here’s a few television insurance lead vendors I ran across on Google. Not sure how well they are, but at least you have a start:

Internet Insurance Leads

Now we have covered the “dinosaur” methods of generating good insurance leads, let’s transition to discussing internet insurance leads.

In insurance, there are 3 primary strategies in how to generate insurance leads online. They are as follows:

-

- Facebook,

-

- Google Search, and

-

- YouTube.

Let’s go over each of these.

With people more active than any other social media, Facebook is arguably the best way to market online.

And whatever you feel about the Cambridge Analytica scandal, Facebook is firmly committed to being a treasure-trove for advertisers everywhere.

I can target 65-year-old females that make $50,000 or more a year, who have an affinity towards Dave Ramsey, live in Louisville, Kentucky, and voted for Donald Trump in 2016.

With Facebook’s data tracking abilities, it is possible to use all this information and market specifically to those people.

Facebook is a giant data mining operation. Zuckerberg knows everything about us.

In fact, I bet 10-to-1 you’ve been marketed to like this on Facebook yourself and were surprised (maybe creeped-out, even) at the ads showing up.

Facebook Is Good For Agents

For these reasons – good or bad – Facebook is fantastic for insurance agent looking for leads.

Crafting a Facebook insurance lead advertising is simple to do with some basic training.

DIY Facebook Advertising Option

If you’re looking for a paid program, check out my interview with Jerry Moore at Perpetual Intent Marketing.

He describes how he teaches agents how to generate insurance leads on Facebook.

Otherwise, you can do a YouTube- or Google-Search on how to create and manage a Facebook ad campaign.

All the information you’d ever need is out there for free.

Content-Based Marketing

Another longer-term yet useful marketing strategy is content-based Facebook marketing.

The concept is simple.

Post useful articles and videos to your Facebook friends and in groups tangentially-related to your insurance product.

Focus ZERO effort on selling. Simply act as a helpful resource.

Do this long enough and you’ll learn how to generate insurance leads at zero cost from people who are ALREADY sold on you.

And those are the very best leads =).

Paid Leads

The strategies outlined above for paid Facebook insurance lead generation are the same for advertising in Google Search.

You can pay for your insurance ads to show up for certain search terms.

Understand that the competition for ad placement is higher, thus the average cost per lead on Google is more than what you’d experience on Facebook.

SEO Marketing

Alternatively, if organic, cost-free insurance leads entice you, you can spend 12 to 24 months developing incredible, resourceful content for your audience.

If good enough, Google will rank it.

And if it shows high enough, your website will attract a boatload of traffic.

I know several insurance agents who have profited handsomely with this strategy.

Second, here are a few other websites of agents I know of that are highly successful generating free insurance leads from Google:

YouTube

YouTube is a great source for insurance leads, as well.

Simply create useful, educational videos on topics related to your insurance product.

Over time, you’ll begin seeing more and more prospects organically reaching out.

Successful Examples

This has worked very well for me personally, as I learned how to generate insurance leads from my YouTube content.

The leads are high quality and cost nothing.

In fact, most are pretty much sold when they reach out.

Also, Christopher Westfall is an excellent example of producing high-quality YouTube content.

He has thousands of Medicare Supplement clients, almost exclusively derived from his educational YouTube content.

Alternatively, you can pay for leads on YouTube in the same way as Google Search.

Lead Sharing

Centering around life event based insurance lead generation, you can piggyback off of other companies’ lead generation efforts.

This is a low- to no-cost insurance lead generation strategy that can get good results.

For example, you could partner with a diabetic supply company and work their leads for insurance opportunities.

These type of lead sources make great partners.

Typically, you either pay them for their leads or you pay them a percentage of the business in exchange for working those leads.

Even better, you can name-drop on the call making a connection between the other company and yours.

It makes you appear as a trusted partner to the original company.

Example Calling Script

Here’s how the script works:

“I’m calling you because I work with ABC Diabetic Supply and I got your information passed to me. I just wanted to introduce myself. I work with people who are your age and older that are concerned about taking care of final expense coverage. I wanted to stop in for 10 quick minutes to show you how this works and show you what I’ve got. How’s Tuesday at 2:00?”

Anytime you can piggyback on another company’s client list, you’ll measurably increase your appointment setting results.

Get creative and find another industry that targets the market you are selling to.

Seminars

One of the most effective AND efficient ways to generate insurance leads is through seminars or speaking engagements.

This is a scalable strategy I teach my final expense agents.

Of all the lead generating methods, this one is least used.

Why?

Because people list public speaking as their biggest fear, even above death!

Luckily, their loss is our opportunity. =)

Seminar marketing is one of the simplest lead marketing strategies to initiate, as there is always MORE speaking opportunities than speakers.

Paid Or Free?

You have the choice of paid seminar marketing or free seminar marketing.

You can generate leads to encourage prospects to attend your seminar.

For example, there is evidence of this strategy working in retirement planning and Medicare plan selection.

Understand that these methods take a LOT of money to market correctly.

If low- to no-cost seminars sound up your alley, you can target a litany of places for speaking opportunities.

Here’s a short list of what works extremely well:

-

- Senior activity centers,

-

- Residences,

-

- Kiwanis Clubs,

-

- Rotary Clubs,

-

- VFWs,

-

- Churches,

-

- Women’s groups

Anywhere people gather presents an opportunity for a speaking engagement.

Speaking Builds Phenomenal Levels Of Trust

Seminars allow you to establish both trust and rapport with your prospects.

As long as you don’t sound like a dope, most of your audience will assume you’re the expert.

Seminars also leverage the “one-to-many” method, meaning you spend your time more efficiently speaking to many people about what you do.

Of all the insurance lead strategies mentioned, seminar marketing is my favorite way to generate leads.

The prospects know and like you, and are more willing to do business.

It’s a pleasurable selling experience!

Referral And Sphere Of Influence Marketing

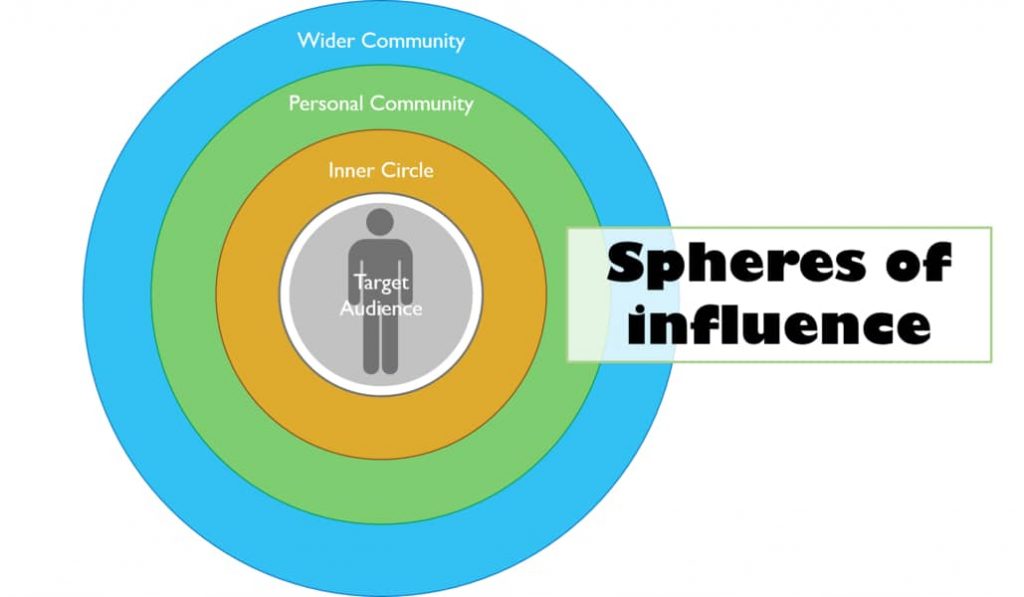

Sphere of influence or referral marketing is broken down into multiple strategies.

Many Hate Warm Market Prospecting

Now, some agents reading this may see the words “referral marketing” or “sphere of influence,” and look for the nearest roof to jump off of.

Why?

Because many agents in traditional agencies were brought up on the Project 100 or Project 200 method.

Here’s how it works…

The agency asks the new agent to create a list of 100 to 200 people.

These people are past business associates, friends, family members, et cetera.

Once you’ve curated this sphere of influence list, the agency wants you to do 1 of 2 activities:

-

- Pitch the insurance product to them, or

-

- Ask them for referrals (whether they buy or not) of people who might have interest.

I’ve made jabs routinely at the Sphere of Influence approach, as many people nowadays hate making their friends and family buy from them.

However, sphere of influence marketing is a proven strategy that works well for the agent that executes.

Example Of Success

Here’s an example of how sphere of influence marketing works better than purchasing leads.

I do jiu-jitsu. I experience intermittent knee pain when rolling from years of weighted lunges and squats.

To reduce the pain, I looked into knee wraps.

In my due diligence, I watched a video from a guy I like a lot and he made a recommendation for knee supports.

I went online to look the product up and saw that it cost 100 bucks for one sleeve.

Today, I was in jujitsu class and decided to discuss knee wraps with a black belt I like and trust.

I asked him his advice on knee wraps, and he described his and why he liked them.

Of course, I took his recommendation over the video advertisement.

Referrals Have The Most Influence

Why?

The business associate, friend, or family member who you respect has MUCH more leverage in influencing your buying decision than a random phone call or internet advertisement.

That’s how referral generation works.

It overcomes many obstacles in buying.

And if you want the power of high-closing leads, you want to influence your sphere of influence to think of you as the insurance man to recommend.

Even better, referrals refer more referrals!

Years of selling helped me realize that the old adage is true…

“Birds of a feather, flock together.”

And people who take referrals from others tend to reciprocate and willingly refer you to others.

Having my own business, I love referrals.

And I love giving referrals as I understand the sales potential they provide to my business friends and acquaintances.

If you ask for help getting in front of target prospects, good people will reciprocate.

If you’ve done a good job for them, they want to see you succeed.

Other Referral-Generating Strategies

Don’t like the Project 200 strategy?

No worries. You can generate referrals through other methods.

Professional Referrals

You can work with other sales professionals and business owners and work their clientele.

If you’re interest in getting mortgage protection leads, you’ll want to work with realtors, title companies, even loan officers.

Ask them to send you their client names to talk mortgage protection with them.

Client Referrals

Client referrals involve you targeting your clients and asking them to give you referrals.

While this strategy works incredibly well, it takes a level of dedication and training to make it work.

I did a great interview with sales trainer Claude Whitacre.

I recommend that you read his sales prospecting book which includes his entire client referral generation strategy.

Hands down, it’s the best referral training I’ve ever gotten.

The 80/20 Rule

Regardless of the referral techniques you use, the Pareto Principle applies.

Simply asking your clients for referrals will constitute 80% of your success in developing referrals.

As I’ve learned from Claude, it’s better to get referrals from actual clients, not prospects that didn’t buy.

Why?

Because buyers hang out with buyers, and non-buyers hang out with non-buyers.

Sample Referral Lead Generation Script

What do you say to ask for a referral? Here’s a simple script you can use:

“I do all my business through referrals. That’s how people do business with me. Can you think of one or two family members or friends that you think would appreciate what I’ve helped you with today? I’d like to talk to them. They wouldn’t be obligated to buy anything, I just want to show them what I have and help them out if I can.”

Booth Marketing

Booth marketing involves you attending a convention (even a flea market) and soliciting people that walk by.

I’ve had agents that have been successful doing this.

Although I was selling my personal training services, I had great success booth marketing.

How Booth Marketing Works

Here’s what I did…

I put out a fishbowl out and offered my services for free to a lucky winner.

The convention attendee filled out an entry card, which was my lead card.

I would contact those people for appointments to investigate what I had to offer, even if they didn’t win the free personal training package.

Some of those people will say “yes” and turned into great clients.

Ideas For Prizes

Ideas for grand prizes could be simple.

Perhaps you spend $300 on a television and a lower amount on a few consolation gifts.

This boosts entries, thus your opportunity to book appointments.

You can always give a gift to anyone who sets an appointment, too (while this is OK in Tennessee, check your local insurance laws).

Something like a $5-$10 gift card works great to “bribe” yourself into an appointment.

Strategic Cold Canvassing

Think door-to-door prospecting is bunk?

Think again!

Door-to-door cold calling is a fantastic way to generate insurance leads.

Especially in combination with working a life-event style of list like mentioned earlier.

Plus it’s a low- to no-cost way of prospecting if money is tight.

Let’s cover a few different strategies where cold calling is used effectively.

Cold Calling Residences

Let’s first cover cold calling residences for insurance prospects.

Up front, understand that cold calling residences is TOUGH.

And you’ll get more mileage out of your prospecting working a list contingent on recent life events.

Life Event Prospecting Works Wonders

For example, if cold call leading with Medicare to those turning 65 within the next few months, you’ll get all sorts of positive reception.

Why?

Because starting Medicare was top of mind BEFORE you showed up.

In other words, the odds are higher you can begin a productive conversation that ultimately leads to a sale.

Same with new home buyers.

You could buy a list of new home owners and simply show up at the door to introduce yourself, explaining how you help with life insurance.

Cold Calling Small Businesses

Another lucrative prospecting strategy is to cold call small business owners for insurance opportunities.

If someone put a gun to my head and told me I had to pick one market to sell to, I would hands-down call on business owners to develop business insurance leads.

Here’s why…

Mo’ Money, Mo’ Problems

Business owners have problems only life insurance can solve!

For example, smaller businesses often don’t have employee benefits.

You can remedy that with voluntary payroll deduct insurance where the employer pays nothing to sponsor the insurance.

Or maybe the business owner has ignored his own personal retirement strategy.

Show him supplemental life insurance retirement strategies utilizing indexed universal life products.

One cool thing about developing business insurance leads…

They are accustomed to making decisions on the the spot.

They’re in business, after all, and must make dozens of important decisions daily.

Also, most business owners are very receptive to salespeople with the guts to show up cold.

They understand the process of finding new business, and usually will at least give you a minute to explain why you’re there.

Obituaries

Ok, so this one is a little weird, but hear me out.

I wouldn’t go to a funeral and start nudging grieving family members about peddling burial insurance to them.

But, if you know people who have died or you read an obituary, and you know the people who may have known the person who died, they make great life insurance prospects.

Death is a life event for the bereaved, and often the cost of the burial is rather shocking.

As a final expense agent, I’ve talked to all sorts of people that run out and buy insurance immediately when a loved one dies.

So, I support talking (tactfully, of course) to people who have experienced the death of a loved one.

They’ll be more inclined to listen to you about how life insurance can help.

News Stories And Promotions

Here is an interesting way to find insurance business.

It takes a little creativity, but it can work wonders if done consistently.

In his book Talking To Strangers, Peter Rosengard talks about how he made the largest life insurance sale ever recorded in human history… all off of a well-placed cold call.

How did he do it?

Simply by reading the newspaper, and thinking creatively!

How He Did It

He read about music legend David Geffen’s company Geffen Records getting acquired by MCA Universal for $550 million dollars.

Peter thought, “Huh, MCA is buying David Geffen’s brains. He’s a key person to MCA. If Geffen dies, then MCA company is in big trouble.”

So, with the sales concept crystalized in his mind, Peter tracks down and cold calls MCA President Sidney Sheinberg while traveling in France in his hotel and says the following:

“Congratulations on hiring David. It’s great that you got him on-board. The reason I’m calling is I’m a life insurance agent. I help companies like you insure their key man. What would happen if David walked under a truck tomorrow? Would that have a negative effect on your business? Could you potentially lose millions?”

Sidney said, “Yeah, what are you proposing?”

Peter replies, “I’m proposing that we sit down and talk about a policy to cover the company if this key person were to pass away to offset the losses that would come from it.”

Sidney remarked, “You’ve got a lot of chutzpah to call me like this!”

Two weeks later, Peter sat in front of the MCA board and closed the deal for a $100 million dollar policy on David Geffen!

What’s the takeaway?

News Stories = Reasons To Buy Insurance

News stories and promotions are life events you need to leverage.

And everyday new opportunities are announced in newspapers, magazines, and other periodicals.

For example, there is a very large law firm in town who advertises in the Chattanooga Times-Free Press when they hire or promote their attorneys.

Last I heard, attorneys make great money and have a need for what we do.

Sounds like a good prospect to me! Especially ones that are moving upward in their careers.

In fact, how many people are calling to congratulate these people on their promotion? Very few to none, I’d wager!

Use this script to book these types of appointments:

“Congratulations on your promotion! I read about it in the newspaper. I just wanted to congratulate you on nice job and possibly talk to you about insurance because if you’re getting a promotion you have a need for more income protection in case you died early. I’d like to stop by and spend 10 minutes showing you the kind of work I do. How’s tomorrow at 2PM or would 10AM work better?”

Use this strategy for newly-opened businesses, or businesses celebrating a recent expansion.

If a business is making moves to expand, odds are higher they have greater insurance needs.

I’m telling you, business owners are usually never fully appreciated.

They love telling their story about how they built their business from scratch and how they fought tooth-and-nail and barely survived.

I know they love telling their stories because I love telling my story.

And what’s great is you can count on the fact that virtually no one else will bother to share congratulations.

People are feeling good about positive recognition.

Marriage Announcements

People who are getting engaged or married, even those who are getting divorced and are paying child support, are sometimes receptive to life insurance.

Somebody who’s recently engaged or recently married is thinking about a future life together and raising a family, so they feel a type of obligation to their spouse to take care of them.

Because life insurance is an act of love, and these people love each other, it’s a great time to approach them.

Conclusion: Pick An Insurance Lead Strategy That Works For You

So, what’s the best insurance lead strategy for you to use?

My recommendation is to find an insurance lead strategy that best fits your personality type.

Then, go ALL in.

Don’t Do This…

Here’s what I DO NOT recommend…

…Dabbling with 3 or 4 different lead programs with minimal commitment.

Pick one and run as hard as you can.

All the greats in the insurance business do exactly this.

Remember There Will Be Ups AND Downs

Remember that insurance lead generation doesn’t work all of the time.

You can run a great lead system with a rock-solid sales strategy and still not make sales.

Odds are low, yes, but every top producer experiences lulls in performance.

So, don’t expect your insurance lead system to only send you buyers.

You have to run appointment volume high enough where your ups and downs are mitigated.

Usually that’s around 15 completed appointments a week.

All of these work, but that doesn’t mean you’re going to run into problems.

Be Glad It’s Tough!

And be glad that insurance lead generation is tough. It thins the heard of competition.

Accept there’s going to be difficulties. It’s very hard to avoid a few bumps along the way.

Be fully committed through the prospecting and sales process because success in this business ultimately comes down to a numbers game consistently executed over the long-haul.

Focus on the input to get the output you want. Go all in. And be TOTALLY dedicated.

If you want to see many of these strategies work in real life, check out my book Interviews With Top Producing Insurance Agents to see what high-income earning agents do to succeed in the insurance business every day.

If you liked this article or have any questions, feel free to leave a comment in the section below. Thanks for reading! Take care!

Interested In Working With David Duford?

To learn more about selling insurance with David Duford, reach out here.

We have access to all sorts of benefits for insurance agents, including:

-

- Top contracts for new and experienced agents. David Duford recruits and operates at FMO/IMO levels, giving him buying power to offer commission levels to agents and agencies others cannot match.

-

- Affordably-priced, high-quality lead programs for direct mail, Facebook, and telemarketing insurance leads. David does not profit from the sale of leads, only referring you to sources with a track record of success.

-

- An endless supply of top-notch prospecting and sales training at your fingertips.

-

- Weekly sales training calls with David, ride-along training opportunities with David and his team, and direct phone/text access to David when you have case placement and sales questions (yes, David answers his own phone =).

-

- Additional training and support for agents interested in cross-selling Medicare Advantage, annuities, or growing their own insurance agency.

Reach out to David by starting here. Talk soon!

January 03, 2023

January 03, 2023

January 03, 2023