Are you a final expense agent interested in adding Guarantee Trust Life’s near-guaranteed issue product to your final expense insurance companies line-up?

Do you want a “No BS” overview from a field-tested agent on how this company’s final expense product performs?

If so, you have found the right article!

I’ll be discussing at length how Guarantee Trust Life’s almost guaranteed-issue final expense product stacks up and why final expense agents should pick it up.

I’ll also give you my opinion on its pros and cons as a producing agent selling final expense insurance.

NOTE 1: Interested in buying a GTL policy? Go here.

Quick Article Navigation Links

Overview Of The Guarantee Trust Life Heritage Plan Product

Application Type: Verbal authorization application (your client is NOT required to sign anything digitally)

Agent Support Hotline: 800.338.7452

Point Of Sale Interview Required? Yes

State Availability: All states EXCEPT CA, MT, and NY.

Paper Application Submission: N/A

Average Policy Issue Turnaround Time: 24-48 hours

Pay On Issue Or Draft? Advancing ON ISSUE (if eligible)

Can You Sell Over The Phone? YES!

Advancing Available? Six month advance at a $600 cap.

How Far In Advance Can The First Draft Be? Up to 93 days in the future.

Frequency Of Commission Payout: Paid weekly.

Pays Commission On Policy Fee? No.

Age Rating: Age based on effective date, *not* application date

Chargebacks On Death: If death within first year, they charge back everything

Chargebacks On Lapses: Charge back whatever client hasn’t paid that was advanced

Underwriting Overview: No MIB check

Agent Guide: Download here

Requires E&O? No

Acceptable Payment Methods? ONLY checking and savings accounts

Face Amount Issue Limits For GTL’s Heritage Plan

-

- Graded Death Benefit (Yr 1: ROP + 5%, Yr 2: 50% of Death Benefit, Yr 3 & Beyond: 100% of Death Benefit

-

- 40-90: $2,500 to $25,000

-

- Graded Death Benefit (Yr 1: ROP + 5%, Yr 2: 50% of Death Benefit, Yr 3 & Beyond: 100% of Death Benefit

Available Riders: No

Cover Foreign Nationals? No

Height-Weight Chart? No height-weight chart!

Sample Final Expense Application: TBA

Rate Guide: TBA

Prescription/Rx Guide: No RX Guide!

Underwriting Advantages:

-

- Near Guaranteed Issue: Accept/reject underwriting based on five health questions on the application. No MIB, RX Check, MVR, or Height-Weight Chart!

-

- Telesales-Friendly: Verbal authorization application makes it easy to sell over the phone or in-person (no paper version of the app).

-

- Social Security Billing Friendly: Reduce lapses and increase profitability with true Social Security deposit billing.

-

- True Graded Product: Beginning of 2nd year, the product pays 50% of the death benefit, unlike Gerber, AIG, and Great Western, in which only premiums are paid back plus 10% interest in Year 2.

-

- Flexible Age Availability: 40-90 years old! Very useful for many hard-to-cover cases.

-

- Superior rates: Beats out most guaranteed issue or near-guaranteed issue carriers.

-

- Replacements Allowed. Guarantee Trust Life allows replacements with this product. Nice =).

-

- Great Commissions. Solid first-year commissions AND pays renewals years 2-10.

-

- NO Smoker Rate Up

Health Questions

What follows below is a list of Guarantee Trust Life Heritage Plan’s final expense product’s health-qualifying questions your prospect will need to answer in order to potentially qualify for coverage.

NOTE: There are ONLY 5 questions necessary to answer to qualify. And a reminder, no MIB, Rx check, MVR, or height-weight is considered to qualify. Just a yes/no approval process.

Accept/Reject Underwriting (There are 5 Yes/No Questions and Any that are answered “YES” would disqualify an applicant.)

-

- Within the last twenty four (24) months, have you been receiving kidney dialysis, require 24 hour continuous oxygen use (excluding CPAP), have an implanted defibrillator or received or been advised by a member of the medical profession to get an organ transplant?

-

- Within the last twenty four (24) months have you been diagnosed with or treated by a member of the medical profession for Alzheimer’s, dementia, or memory loss?

-

- Currently diagnosed as having, or receiving treatment by a member of the medical profession for invasive cancer (excluding Stage A Prostate cancer, Carcinoma in Situ, and Squamous Cell/Basal Cell Carcinoma)?

-

- Are you currently bedridden, confined to a hospital, nursing home, mental care facility, long term car facility, hospice or been diagnosed with a terminal illness?

-

- Have you been diagnosed by a member of the medical profession as having the Human Immunodeficiency Virus (HIV), ARC, or AIDS?

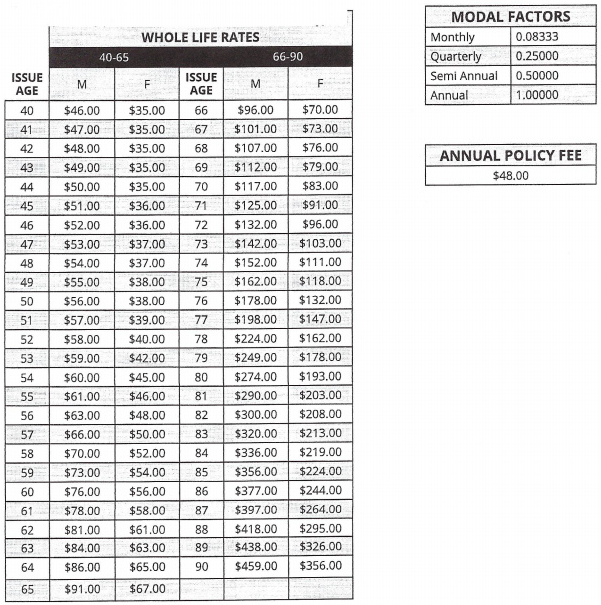

Guarantee Trust Life Heritage Plan Rate Guide

Below you’ll find the rate chart for GTL’s Heritage Plan.

NOTE: There are NO smoker ratings.

Thoughts On Writing GTL’s Heritage Plan For Final Expense Prospects

Since starting in the final expense business in 2011, I’ve written many different final expense products.

Some are good, and some are just… blah =).

The good news with Guarantee Trust Life’s new final expense product is it’s apparent that they’ve paid attention to what agent’s are saying they need in a quality product.

Bottom line, GTL offers a strong final expense product solution that will lead to better first-year persistency than other guaranteed issue products, and should definitely be apart of your final expense portfolio.

Advantages Of Writing GTL’s Heritage Plan

Almost Guaranteed Issue

GTL’s final expense plan is “near” guaranteed issue.

This means you’ll cover folks otherwise only eligible for guaranteed issue.

Cases you’ll be able to cover with GTL that are normally covered with guaranteed issue include:

-

- Recent cardiac history within the past 1-2 years: (heart attack, stroke, stent, bypasses, seizures, annurysms, congestive heart failure, cardiomyopathy, etc.)

-

- Cancer-free and treatment free within the past 1-2 years.

-

- Current hepatitis C or liver disease

Competitive Rates Available From Age 40 to 90

Where you’ll find Guarantee Trust Life’s Heritage Plan very useful is in covering younger AND older final expense prospects.

Any client between age 40 to 90 can take out a GTL plan. Nice!

And rates are competitive, too.

I compiled a rate chart comparison between the major guaranteed issue carriers and near guaranteed issue carriers to see the difference:

[table id=69 /]

Ease Of Use For Agents And Clients

Guarantee Trust Life’s Heritage Plan is super easy to use for agents, as they only require the clients verbal authorization to approve the product.

That means no wet signatures (paper applications aren’t even allowed), and definitely no e-signatures.

This is especially helpful for final expense telesales agents who find it frustrating walking a client through a digital application signature process.

Also, GTL offers true Social Security Deposit Billing with the Heritage Plan.

This means we can draft premium payments on the EXACT deposit date our client receives her money.

Less time between deposits and drafts means higher first year persistency and increased profitability.

Drawbacks

There are a few drawbacks to the GTL product:

-

- No paper application process: For all you dinosaurs out there accustomed to paper applications, you’ll find that GTL does NOT offer ANY paper application process. Only digital e-app and verbal authorization processes only.

-

- Can’t cover all GI clients: Unfortunately, you can’t shift over ALL of your current GI prospects to Guarantee Trust Life.

Summary

Bottom line, Guarantee Trust Life’s Heritage Plan product offers excellent pricing, excellent quality, and fantastic ease of use for the writing agent.

I predict many agents will utilize GTL in large numbers, making it a primary choice for many prospects young and old not healthy enough to fit into a first-day full coverage option.

Want To Sell GTL’s Heritage Plan Near Guaranteed Issue Product?

To learn more about contracting, reach out here.

We have access to all sorts of benefits for final expense agents, including:

-

- Top contracts for new and experienced agents. David Duford recruits and operates at FMO/IMO levels, giving him buying power to offer commission levels to agents and agencies others cannot match.

-

- Affordably-priced, high-quality lead programs for direct mail, Facebook, and telemarketing leads. David does not profit from the sale of leads, only referring you to sources with a track record of success.

-

- An endless supply of top-notch prospecting and sales training at your fingertips.

-

- Weekly sales training calls with David, ride-along training opportunities with David and his team, and direct phone/text access to David when you have case placement and sales questions (yes, David answers his own phone =).

-

- Additional training and support for agents interested in cross-selling Medicare Advantage, annuities, or growing their own insurance agency.

Reach out to David by starting here. Talk soon!

January 03, 2023

January 03, 2023

January 03, 2023

![Cover - Guarantee Trust Life (GTL) Heritage Plan Review [For Agents Only]](https://davidduford.com/wp-content/uploads/2023/01/guarantee-trust-life-final-expense-review.jpg)