I recently conducted a survey where I asked mostly life and health insurance agents across the country their thoughts on their future in the insurance industry.

Most likely a lot of you who are reading this are considering a career or new to selling insurance, and want to know what the future of the insurance industry holds for agents.

Will it have a positive or negative impact on your insurance sales career?

For example, is there a big company ready to come to the market and take market share, making it difficult for agents to sell?

This survey tried to get to the heart of these and other questions. And the results were pretty interesting.

Let’s jump right in!

Quick Navigation Links

Survey Details

The survey was completed between June 5th, 2020, and June 9th, 2020.

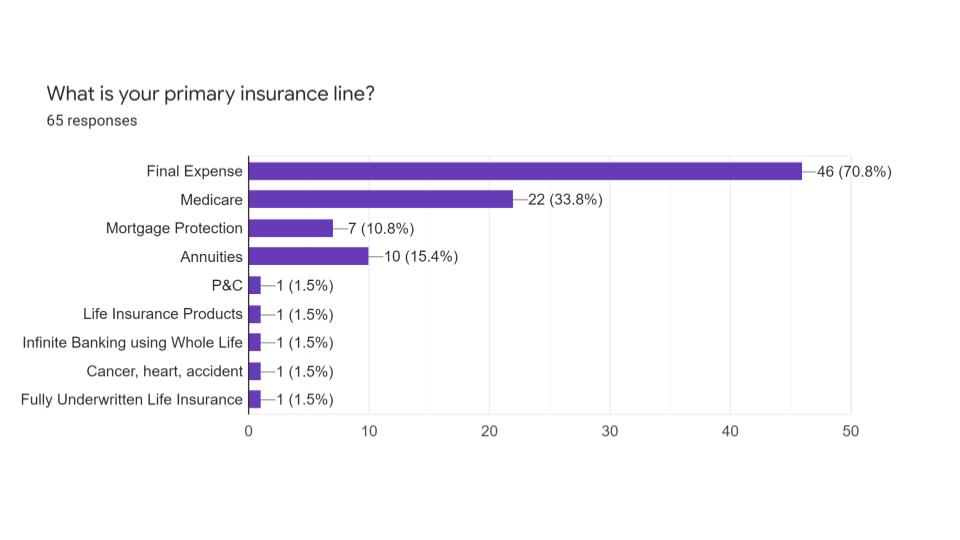

Viewing the chart above, almost all agents completing the survey focuses either in selling life insurance or health insurance like Medicare Advantage.

Increase In Future Insurance Telesales/Virtual Sales?

The first question I asked related to the COVID-19 pandemic and its effect on insurance agents.

As I conducted the survey, we’re really right smack dab in the middle of the pandemic.

And over the past couple of months, there’s been a huge upsurge of interest in selling insurance over the phone or virtually.

I wanted to survey agents to get their thoughts on a future with more telesales.

The question:

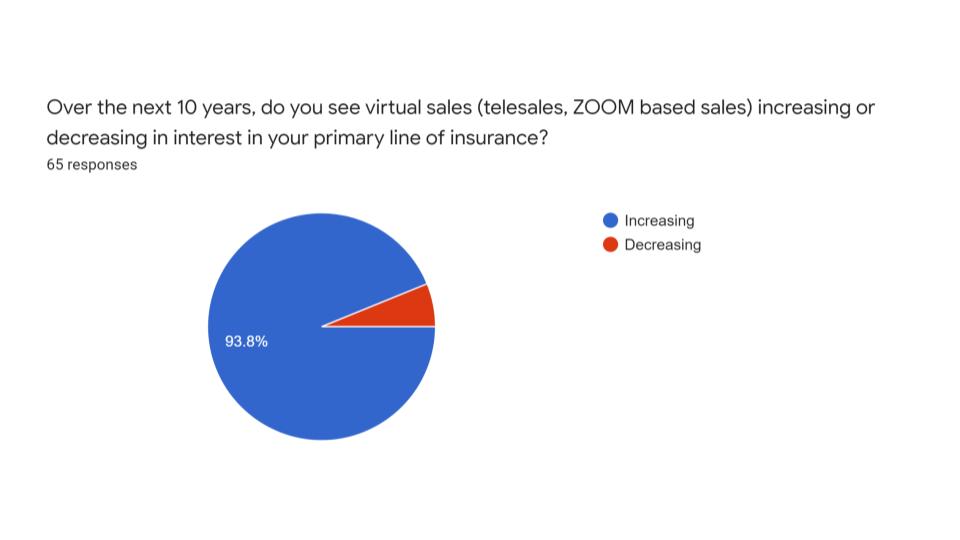

Over the next 10 years, do you see virtual sales such as telesales or zoom-based sales increasing or decreasing in interest in your primary line of insurance?

-

- 93.8% of respondents answered yes, they do see the virtual sales model increasing with only a fraction.

-

- 6.2%, said they see it decreasing.

Maybe it’s because of what’s going on with COVID-19, and its impact on how we sell insurance, but I’m not too surprised about this.

If you’ve paid any attention to where the insurance business has headed from a sales process, virtual sales systems have all increased in popularity.

Coronavirus has accelerated that process.

For example, a few friends in the business doing telesales have seen fantastic growth when everybody was locking the doors and not coming out because of the fear of getting infected.

People still had interest in insurance and the numbers really back that up.

Expect More Telesales

<div class=”displayphoto d-none” data-type=”2″></div>

Personally, I think we’ll still see more of this trend over time, not just for life and health, but for other insurance product lines, too.

You see a ton already, while other niches are playing catch up.

Will Technology Disrupt The Future Of Insurance Agents?

One big risk insurance agents is technology’s impact and threat of replacing our work.

For example, what about artificial intelligence? How will AI affect our ability to help our clients?

Or, will “InsureTech” like Haven Life and Lemonade replace the normal face-to-face or over the phone telesales agent?

The question asked (on a scale of 1 to 5, with 5 being very worried) was:

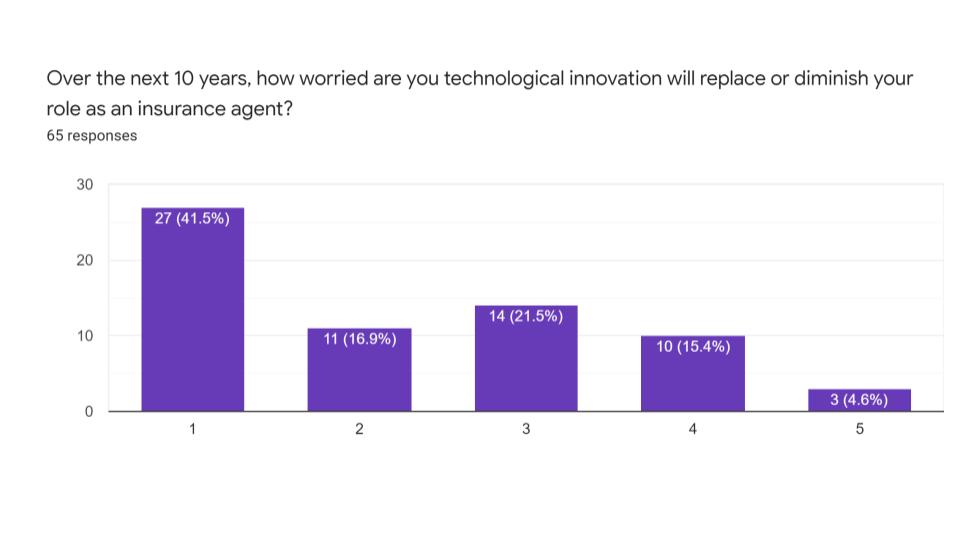

Over the next 10 years, how worried are you that technological innovation will replace or diminish your role as an insurance agent?

-

- Approximately 80% of respondents were neutral to not worried at all.

Why are most agents not too concerned?

We’ve seen huge industry shifts in a lot of industries.

For example, real estate with the advent of Zillow has taken a lot of market share away from real estate agents.

We see other industries like Carvana attempt to displace the car lot industry with a virtual sales opportunity.

First, I think the nature of the agents that are taking the survey is a reason why there is less concern.

Many are selling final expense insurance, which is a traditionally a face-to-face type of sale.

Additionally, seniors targeted aren’t as sophisticated technologically, meaning they need more personal service.

If we had maybe more P&C agents or agents targeting a younger, I think we might see a difference here.

However, it’s important to point out there’s something about this business regarding the impact of service.

Effective insurance consultation demands client customization, listening to their needs in order to make a recommendation.

We’ll circle back to that later, but it’s food for thought. Selling insurance is a little different than others, and I’ll expand on that later.

Is There A Threat From Big Companies?

Right now in the insurance world, there are no centralized players that dominate the entire market.

There are no Amazons in the insurance business. It’s very decentralized.

There’s a lot of different players out there. Part of the reason I think this is the case is that we’re taught that insurance has to be sold. It’s not bought.

I wanted to ask this question specifically because it’s happened in so many other industries where a big player gobbles up market share.

I wanted to see what agents who were in the field right now think about somebody coming in and possibly just totally disrupting the marketplace.

The exact question I asked is:

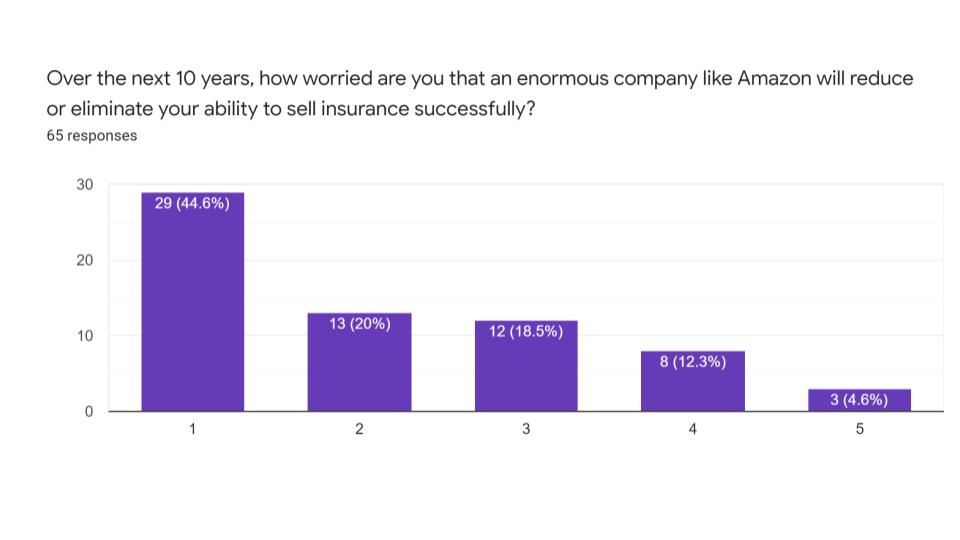

Over the next 10 years, how worried are you that an enormous company like Amazon will reduce or eliminate your ability to sell insurance successfully?

Little To No Concern

This graph is kind a more extreme version of the last graph in terms of positivity.

As you can see, more than half of the people either are not worried at all or not really that concerned. A small number are moderately not worried.

Why is this the case?

Is this a function of agents putting their heads in the sand, and not reading the tea leaves of some big company coming in and eliminating us all?

I don’t think so.

This comes back to really the way insurance is sold, and how it’s sold, and the process of how it’s different than other product lines.

And I think so much of this business oriented around service and value-added activities that it’s not like retail, where you can buy products without leaving the home.

There’s something about insurance that’s unique in that regard. It’s not a normal product sale, which I think again, comes back to that service orientation, which we’ll cover shortly.

The Future Of Insurance Sales

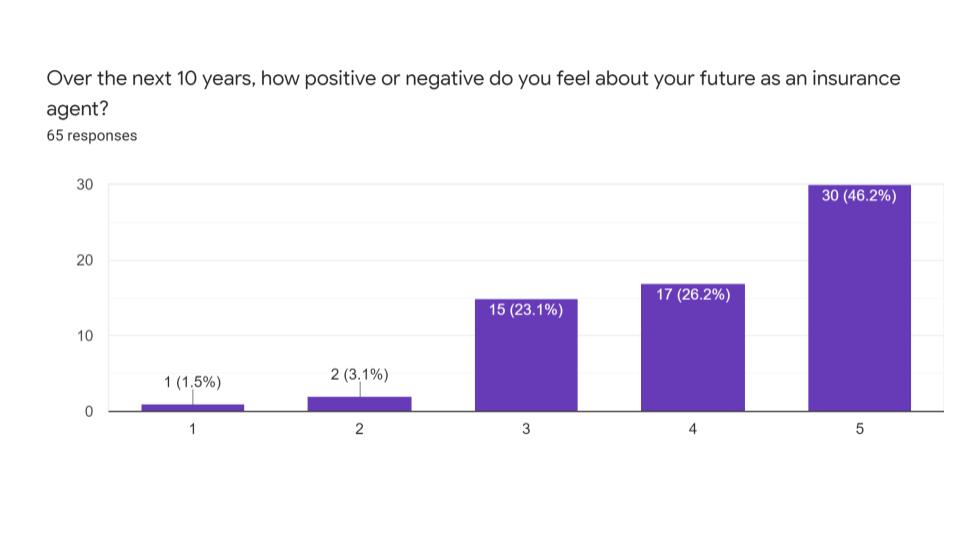

For my last question I surveyed my respondents to basically get some feedback on how they feel about their future as insurance agents over the next 10 years.

For my last question I surveyed my respondents to basically get some feedback on how they feel about their future as insurance agents over the next 10 years.

With everything that’s going on currently at the writing of this, including COVID-19, the possibilities of government interference, or possible changes in the environment economically, what do they think about what’s coming down the pike?

The exact question asked was:

Over the next 10 years, how positive or negative do you feel about your future as an insurance agent? With one being very negative, and five being very positive.

Again, we have another very heavily biased opinion from actual licensed agents about their future being at worst neutral, and at best overwhelmingly positive, with only approximately 5% being negative.

That means 95% are either neutral or absolutely positive.

That’s incredible!

Lessons Learned From The Survey

Let’s hit on some important takeaways.

Service Is King!

Agents think the best way to differentiate and survive long term is with a commitment to service.

What do we mean when we say service?

A lot of people just simply don’t understand how insurance works. They don’t know the difference between the different varieties of products out there.

Term insurance, universal, whole life… they can’t make an informed decision on what works best simply because there are so many conflicting opinions, and all those conflicting opinions are just that.

By its nature, those opinions are not personal or tailored to the particular person who has to make a judgment on what type of insurance they’re going to purchase.

What invariably happens is that people look to experts, advisors, and trusted people like insurance agents to help them understand their options.

In other words, consumers want agents to help take the complex and make it simple, then help them choose which of the products out there is best suited for their particular goals.

The Personalization Aspect Is The Biggest Barrier To Entry

I think that’s part of the reason we don’t see an Amazon in this space yet.

This is simply because you can’t suggest options and products and services in the insurance business without a pre-qualifying process, in order to determine what matters to the client, and how are we going to help them with their particular needs.

That’s the essence of what I think agents mean when they say this is a service-based business.

And because of that, I don’t think that some big company is going to come in and eliminate us. And that includes, I think to an extent, the technological risk too.

Technology Alone Isn’t Enough To Reduce Or Eliminate Agents

Technology, as it stands now, makes our lives easier.

But it doesn’t replace the relationship aspect that is unique to insurance sales.

You don’t buy insurance like you would if you walked into Walmart and grabbed a pair of Wrangler jeans.

You can do that anywhere. The jeans there are the same as the jeans over at a different store. It’s the same with cars.

But with the insurance business, there are just so many variables. And people just don’t have a grasp of the facts.

So they rely and believe that an insurance agent on some level to help pick the best options.

Be A Problem Solver, Not A Policy Peddler

The nice thing is if you’re looking at getting into this business this is positive proof that a focus on service will take you places.

You should be focused on becoming an agent that wants to not just make sales, but to help your clients solve their problems.

And if there is any kind of technology upheaval, or a big company that comes in to try to replace us agents, it’s the transactional insurance agents that will get eliminated first.

The best thing you can do is elevate yourself from a peddler to trusted advisor. To somebody that’s going to actually want to help solve problems.

That is a huge takeaway from the survey.

Comments From Survey Participants

Let’s take some time to review the comments I received from agents.

Risk of companies and industry shifts eliminating agents

“In the past big box stores forced little stores out of business like Home Depot, Walmart, etc. I see big business trying to push the agent out of business, but I don’t think the public will go for it. Big companies, meaning the companies instead of individual agents, hands-on servicing the clients.”

“In general, life insurance companies lack vision and show no loyalty to insurance agents. They’ve been facing tremendous pressure from three key areas: low-interest rates, compliance and regulatory technology, and comment technology will eventually be our demise.”

“I can’t see how career agencies, meaning company-owned, can survive. And also, to build an agency, I believe life companies should offer two commission options, one heaped with no minimal renewals and multiple commissions.”

“I have been worried about the future for independent insurance agents. I worry that technology plus changes in government might take away the current situation for agents. But for now things are good to keep going.”

My Thoughts

Clearly, there are some concerns among agents that a bad economy may have an impact on the insurance business. Low-interest environments do create some stress for some insurance concerns.

How worried do we really have to be when it comes to government intervention?

I started in 2011, right smack dab in the Affordable Healthcare Act implementation, and agents were told they would still play an important role in the consumer search for health insurance.

I got to know a lot of agents who had built their entire business around selling private health insurance policies to people under 65 and had accumulated a nice block of business.

Those products at the time paid pretty good renewal streams. These agents did very well, and worked hard for it.

But I think what happened in 2011 is a lesson for all of us to be concerned about.

AFA Destroyed The Individual Health Agent

What the Affordable Healthcare Act did is that it essentially eliminated the health insurance agent as they used to be.

Health insurance companies, I remember at the time, reduced their commissions.

They went from 15%, to 10%, to 5%, to 1%, to zero.

They actually told agents thank you for your business all these years. We’re going to stop paying you, but please keep servicing your clients.

The health insurance agent that went all in on that business lost everything.

It was a damn shame, really.

Beware Inherently Political Insurance Lines

Why did this happen?

Because health insurance is inherently a political thing.

And after many years of trying to at least have some intervention into the market, it’s my opinion that the agent bore the brunt of what happened.

Fast forward to today, there just isn’t the same level of independent agents selling health insurance plans, because there’s just frankly, no money in it, or very little money.

Carefully Consider The Long Term Viability Of Your Selected Product

So what does that bode for us in the future?

Bottom line, consider what products you sell.

If you want to go up, rather than down, in sales you have to consider things like:

-

- What do you have to worry about?

-

- What could be a possible risk over time?

-

- Is this sustainable for the long term?

Medicare is something that’s very similar to healthcare and there’s already talk right now amongst some political candidates to have a Medicare for all type of platform.

I don’t think that’s going to happen now, but I think it will happen one day. I personally think we have at least 15 to 20 years before it does occur.

Medicare is something that I think from a voting block stance is highly protected. Seniors do not want to have their Medicare impacted. They paid into the system after all for many years.

But nothing is certain, so this is definitely something to be considered.

I think the biggest intrinsic risk to our business will come from a governmental standpoint.

Remember, even with all this said and done the vast majority of the agents I surveyed said in their own opinion, there’s so much more opportunity coming down the line than there isn’t any real concern.

A rise in future telesales

A lot of comments mentioned how telesales is the future.

“The advances for telesales will force all parties to come to the party or be left out.”

“There will always be a place for the personal face-to-face agent, but the trend will be to either electronic or call center telesales. Agents will have to adjust to do face-to-face, and offer value, not just products.”

“There will continue to be a market for both virtual sales and traditional face-to-face meetings. We humans are social by nature, which will keep both avenues alive and well. My challenge is to adjust both methods accordingly.”

Service-centered approach for the win

The last thing I want to hit on here from what agents think about the future of their business is how service mindedness is really the critical element to long term success.

I think this has always been the case for all great agents who have had long, profitable careers, as they realize that this business isn’t a transaction.

In fact, the first sale is the first of many. It is the beginning of a long term, fruitful, and prosperous relationship with the client.

What I think you’re going to find if you’re thinking about getting started in insurance sales is that the service-orientation is the absolute best way to have the best odds of success.

Here are some comments I got on this subject.

“People need guidance to navigate the insurance waters with all the changes, new products, and laws and regulations. Be a student of the business and you will be unsinkable.”

“I believe that virtual sales will certainly take a step up, but there will still be a large segment of the population that will want face-to-face sales. It’s hard to see that going away, especially with final expense. The successful agents will adjust and create opportunities while others will use it as the excuse to why they failed.”

“Life insurance must be sold. So I don’t see my job going away anytime soon, it will certainly change. But I see beauty in that as well.”

“As long as money and security is important in this world there will always be a place for knowledge and hardworking salespeople in the insurance industry.”

“In my lifetime, I expect technology to be a driving force for change. I do not expect tech to replace insurance agents anytime soon.”

“I’ve been in the Medicare market long enough to know that the individual is always best served with a face-to-face meeting. The age of the market itself, and all that goes into making a correct decision with all the information that is available, in my opinion, is best transmitted face-to-face.”

“I believe there will always be clients who need human help. Sure. People can purchase insurance online to ‘avoid being sold’ but once they need it or use it, they’ll realize they don’t know what they’re doing. Just my 2 cents.”

“AI will never replace the human factor. Just as long as human beings find a way to survive. The human factor will always find its place in the economy.”

“Insurance isn’t cookie cutter. Most buyers will need questions and answers and a dialogue regarding the best solutions to their needs. Bottom line, AI doesn’t have empathy. A good agent does.”

Conclusion

So there you have it from actual insurance agents and what they think about their future as insurance agents.

Hope you got some questions of your own answered in this survey.

If you still have questions, concerns, criticisms, or comments, feel free to do so below in the comment section.

I’m happy to address all the questions that get posted and reply back with a thorough and thoughtful answer.

And if you found this article interesting, please share it with other insurance agents, especially those who are thinking about jumping into this business.

I think there’s a lot of good data here that tells us this is a good business to commit to for the long term.

And feel free to check out how my national insurance agency works here, review my Agent Success Stories, and check out my best-selling insurance sales and marketing books.

January 03, 2023

January 03, 2023

January 03, 2023