Are you a final expense agent interested in adding Prosperity Life Insurance to your final expense insurance companies line-up?

Do you want a “No BS” overview on Prosperity Life’s final expense product from a field-tested agent?

If so, you have found the right article!

I’ll be discussing at length how Prosperity Life’s final expense product stacks up, and why final expense agents should consider it.

Also, I’ll give you my opinion on its pros and cons as a producing agent selling final expense.

NOTE 1: Prosperity Life Group® is a marketing name for products and services provided by the member companies of Prosperity Life Insurance Group LLC. The New Vista® final expense product reviewed here is underwritten by member company S.USA Life Insurance Company, Inc. Whenever I reference Prosperity Life’s Final Expense product, understand that this means New Vista® issued by S.USA.

NOTE 2: This information is directed at agents only. If you are a consumer looking for information on buying a Prosperity Life final expense plan, you can learn more about the company and product here.

Article Quick Navigation Links

Overview Of Prosperity Life’s Final Expense Product

Application Type: Paper, Telephonic App, E-App (Accessible through smartphone, tablet, or laptop with Chrome browser)

Agent Support Hotline: (866) 380-6413

Point Of Sale Interview Required? No for the paper and e-app.

State Availability: Available in all states EXCEPT: Connecticut, Montana, North Dakota, New Hampshire, and South Dakota. This product IS available in New York State by paper application only.

Paper Application Submission: E-mail to newbusinessprocessing@prosperitylife.com or by fax: (866) 331-3074

Average Policy Issue Turnaround Time: 48-72 hours

Commission Payout: Advances on issue or draft (EFT payments only)

Can You Sell Over The Phone? Yes, in select states only. Contact Dave here for more information.

Advancing Available? Yes – 9 months advance for those that qualify. Debit, cards and Direct Express paid as-earned.

How Far In Advance Can The First Draft Be? 35 days out

Frequency Of Commission Payout: Daily, Weekly, or Monthly

Pays Commission On Policy Fee? Yes

Age Rating: Age based on effective date

Chargebacks On Death: If rescinded; otherwise, only on unearned commissions.

Chargebacks On Lapses: Chargeback on unearned commissions

Underwriting Overview: Instant ID verification, MIB and Rx check

Agent Guide: Contact David here for more information

Requires E&O? Yes

Acceptable Payment Methods? Bank account, Direct Express, or Debit/Credit Card

Face Amount Issue Limits For New Vista Final Expense Plan:

-

- Level, Graded, Or Modified Plans

-

- 50-80 – $1,500 to $35,000 (Minimum in Washington is $5,000)

-

- Level, Graded, Or Modified Plans

Available Riders: Accidental Death Benefit Rider

Cover Foreign Nationals? Must be U.S. Citizen or Legal Permanent Resident and have a Social Security number

Height-Weight Chart? Contact David here for more information

Sample Final Expense Application: Contact David here for more information

Rate Guide: Contact David here for more information

Prescription/Rx Guide: Contact David here for more information

My Favorite Underwriting/Product Advantages Prosperity Provides:

-

- Social Security deposit drafting option available to reduce lapses and improve persistency.

-

- FULL COMMISSION on Graded and Modified Plans (no commission reductions for these plans).

-

- Instant decision with telephonic application and E-App.

-

- E-App availability for tablet or laptop.

-

- Get an INSTANT DECISION using the e-app function without making a point of sale phone call!

-

- 10% quarterly cash bonus opportunity for writing agents! Reach out to David here for more information

-

- Smoker rates apply to cigarette smokers only.

-

- CPAP use for sleep apnea is OK (but supplemental oxygen use is not).

-

- Wheelchair use where the applicant is NOT confined to a wheelchair is OK (but applicant cannot be receiving assistance with activities of daily living).

-

- 3-year look back on cancer diagnosis, cancer treatment (treatment includes taking medication), and cancer removal.

-

- Insulin-dependent diabetes is not a disqualifier for Level coverage, assuming that no complications of diabetes are present (such as insulin shock, diabetic coma, neuropathy, nephropathy (chronic kidney disease), etc.)

Prosperity Life Final Expense Health Questions

What follows below is a list of Prosperity Life’s New Vista final expense product’s health-qualifying questions your prospect will need to answer in order to potentially qualify for coverage.

How The New Vista Final Expense Plan Works

Prosperity Life offers 3 plan types depending on what your client may qualify for:

-

- Level Death Benefit. This provides first-day full coverage from the effective date of the policy for both natural and accidental death.

-

- Graded Death Benefit. This provides limited first-day coverage for non-accidental death. Limited benefit equals a percentage of the face amount (30% Year 1, 70% Year 2). Full death benefit for accidental death, all years.

-

- Modified Death Benefit. During the first year of coverage, the death benefit is equal to 110% of the annual premium (excluding the policy fee). During the second year of coverage, the death benefit is equal to 231% of the annual premium (excluding the policy fee). After the second year of coverage, the death benefit is equal to the face amount of the policy. Full death benefit for accidental death, all years.

Knockout Health Questions

If any question is answered “Yes”, the Proposed Insured is not eligible for coverage

-

- Is the Proposed Insured currently or in the last 30 days been: hospitalized, committed to a psychiatric facility, confined to a nursing facility, receiving hospice or home health care, confined to a wheelchair due to a disease, or waiting for an organ transplant?

-

- Does the Proposed Insured currently require human assistance or supervision with eating, dressing, toileting, transferring from bed to chair, walking, maintaining continence or bathing?

-

- Within the past 12 months has the Proposed Insured: a. been advised by a member of the medical profession to have a diagnostic test (other than an HIV test), surgery, home health care or hospitalization which has not yet started, been completed or for which results are not known? b. used or been advised by a member of the medical profession to use oxygen equipment for assistance in breathing (excluding CPAP or nebulizer)? c. had or been advised by a member of the medical profession to have Kidney Dialysis?

-

- Has the Proposed Insured ever been diagnosed or treated for Acquired Immune Deficiency Syndrome (AIDS) and/or Human Immunodeficiency Virus (HIV) infection by a licensed member of the medical profession?

-

- Has the Proposed Insured ever been diagnosed or received treatment by a member of the medical profession for Alzheimer’s disease, dementia, Lou Gehrig’s/Amyotrophic Lateral Sclerosis (ALS), Cirrhosis of the Liver (Stage C)?

-

- Has the Proposed Insured ever been diagnosed by a member of the medical profession with more than one occurrence of the same or different type of cancer or is the Proposed Insured currently receiving treatment (including taking medication) for any form of cancer (excluding basal cell skin cancer)?

Modified Plan Health Questions

If any question is answered “Yes”, the Proposed Insured may be eligible for the Modified Death Benefit Individual Whole Life Policy

-

- In the past 2 years, has the Proposed Insured been diagnosed or received treatment from a member of the medical profession, or other practitioner, or been hospitalized for any of the following:

a. the use of alcohol or drugs; or been advised by a physician, practitioner, health facility or counselor to restrict the use of alcohol or drugs?

b. complications of diabetes such as diabetic coma or insulin shock or had an amputation due to complications of any disease?

c. heart attack, angina (chest pain), congestive heart failure, cardiomyopathy stroke, transient ischemic attack (TIA), or aneurysm or had heart or circulatory surgery?

- In the past 2 years, has the Proposed Insured been diagnosed or received treatment from a member of the medical profession, or other practitioner, or been hospitalized for any of the following:

-

- In the past 3 years, has the Proposed Insured been diagnosed, treated, or prescribed medication by a member of the medical profession for: internal cancer, including but not limited to, malignant brain tumor, malignant melanoma (but excluding basal/squamous cell skin cancer), leukemia, or multiple myeloma?

-

- In the past 2 years, has the Proposed Insured had more than 1 conviction for reckless driving or for driving under the influence of alcohol or drugs (DUI or DWI)?

Graded Plan Health Questions

If any question is answered “Yes”, the Proposed Insured may be eligible for the Graded Death Benefit Individual Whole Life Policy

-

- 1. Has the Proposed Insured ever been diagnosed, treated, or prescribed medication by a member of the medical profession for:

a. Parkinson’s disease, Systemic Lupus (SLE) or sickle cell disease?

b. Cirrhosis (Stage A or Stage B) of the liver, chronic hepatitis or other liver disorder, kidney failure or other chronic kidney disease?

c. Chronic Obstructive Pulmonary Disease (COPD), which includes emphysema, black lung disease or tuberculosis?

d. Bipolar Disorder or Schizophrenia or been hospitalized in the past 2 years for any mental or nervous disorder?

- 1. Has the Proposed Insured ever been diagnosed, treated, or prescribed medication by a member of the medical profession for:

If all questions in Parts A, B and C are answered “No”, the Proposed Insured may be eligible for the Level Plan.

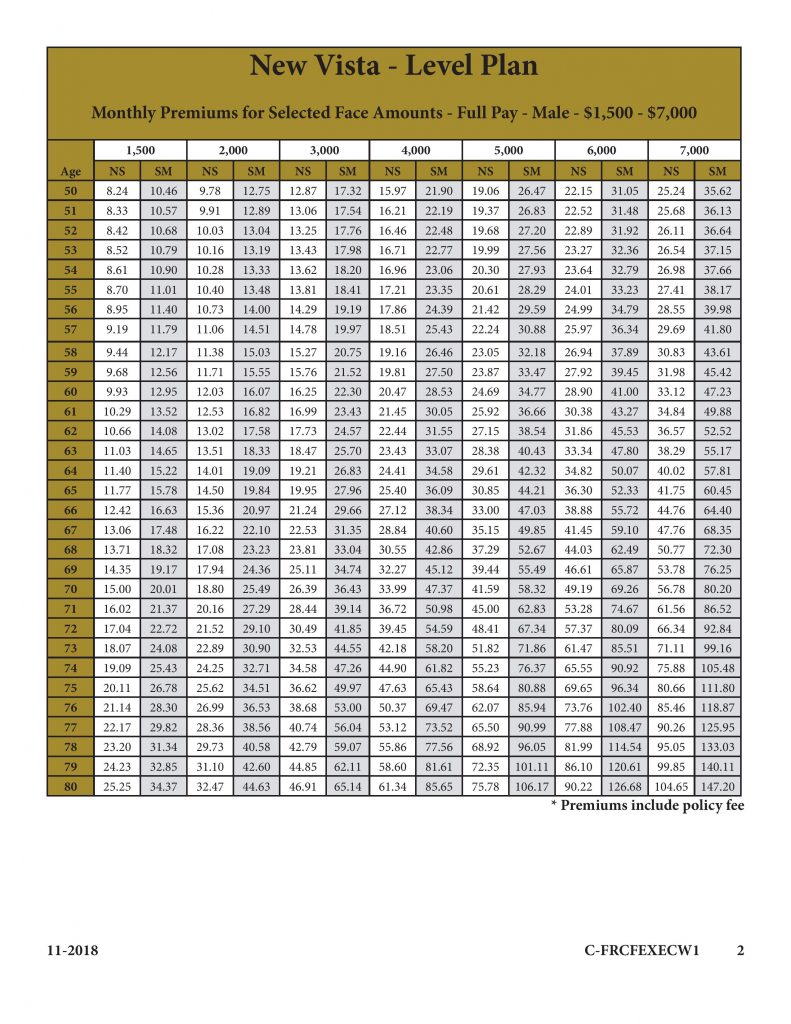

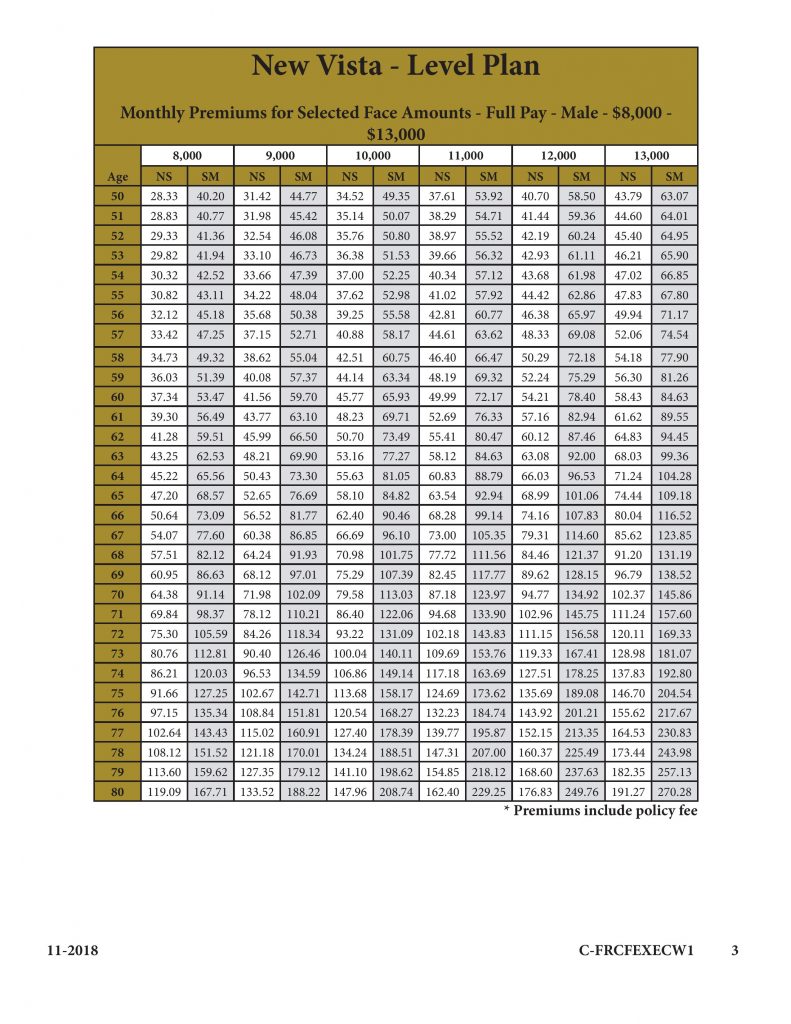

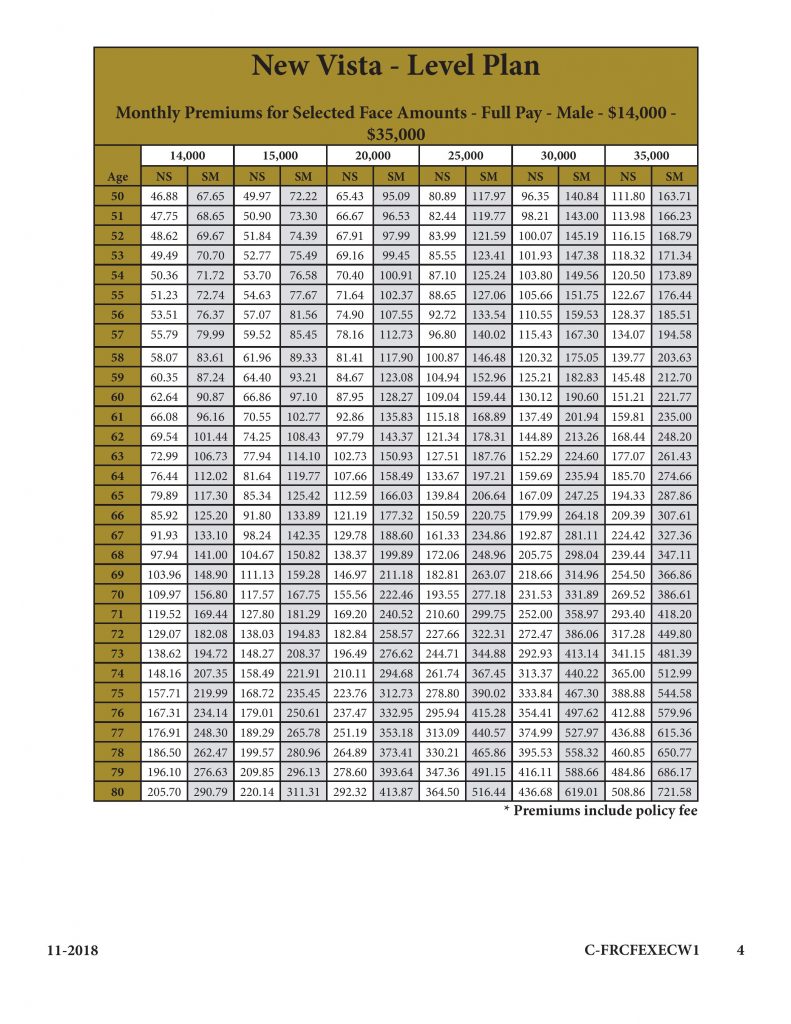

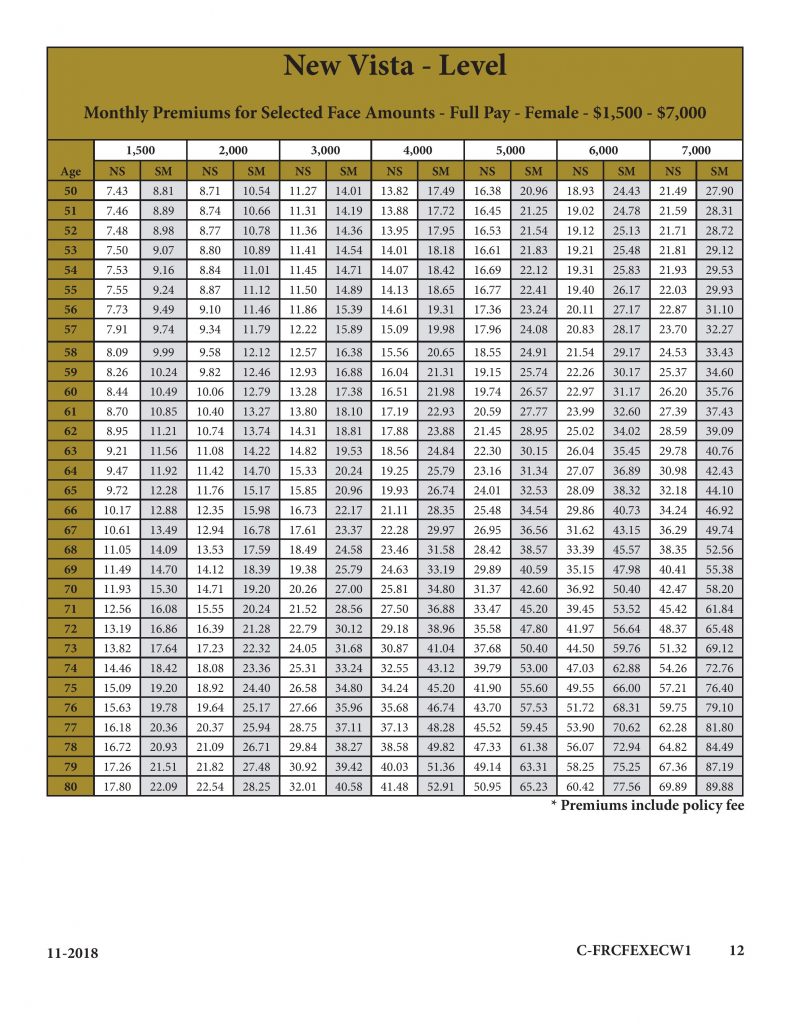

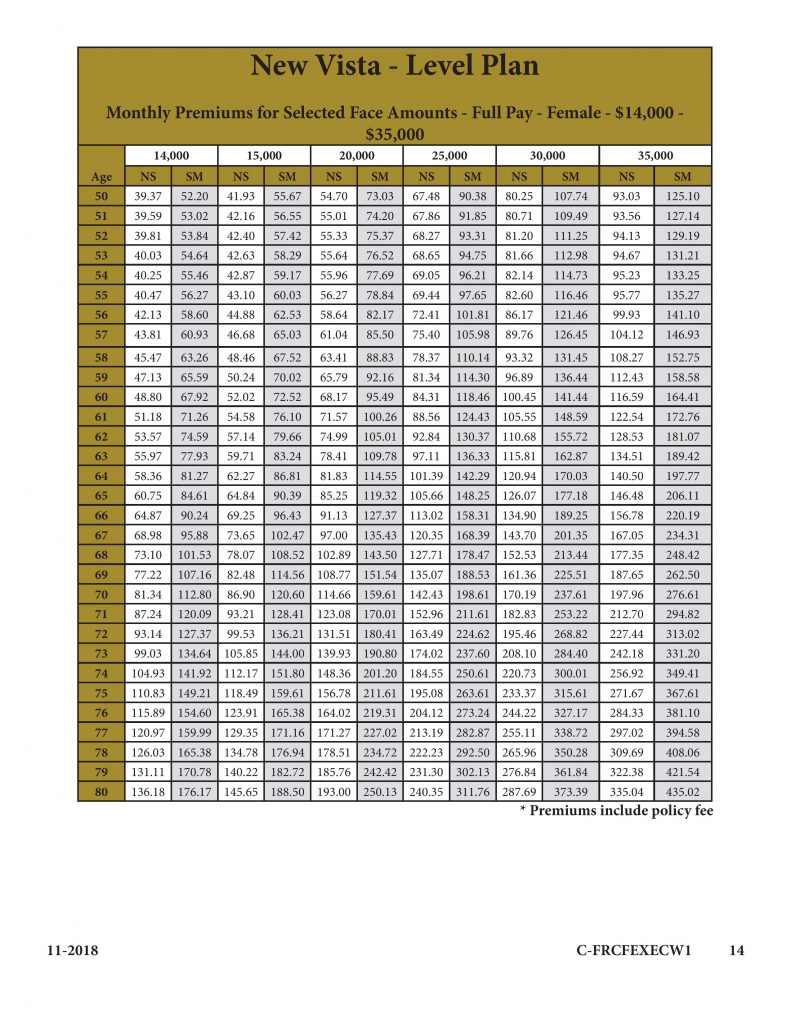

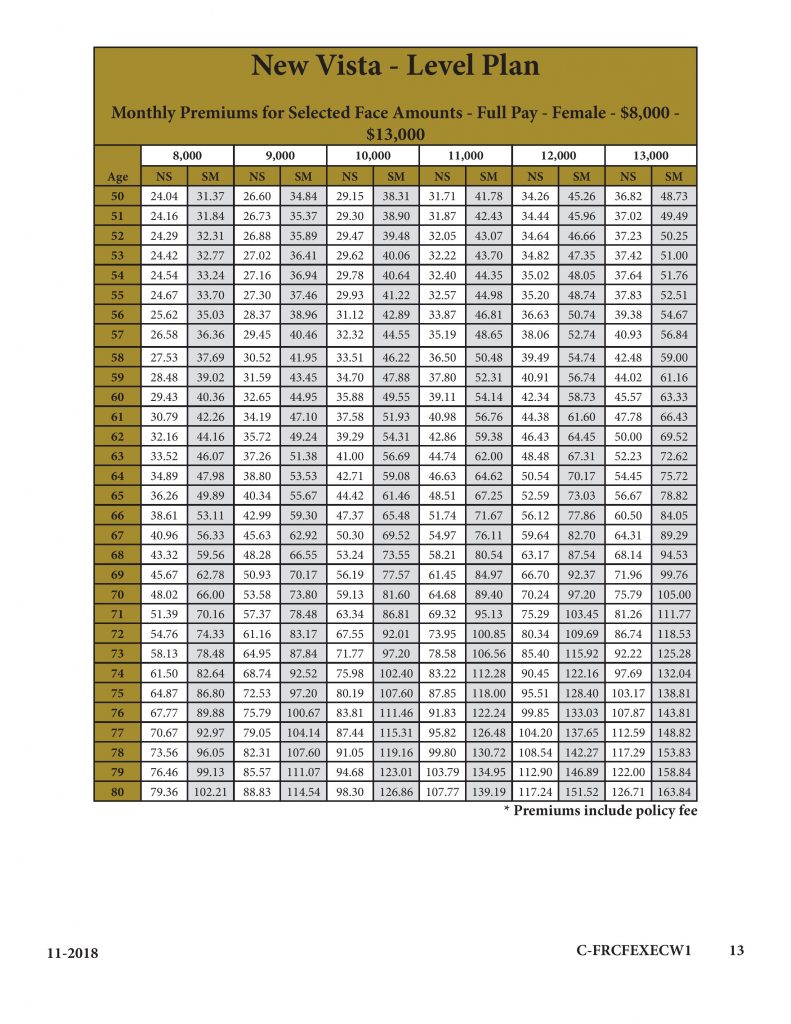

Prosperity Life New Vista Rate Chart

Below you’ll find several charts of rates for males and females for just the Level coverage.

If you want to review rates for Graded or Modified Plans, you can view the complete rate chart broken down by face amounts here.

NOTE: The rates you see are the SAME regardless of payment type. Rates subject to change.

My Thoughts On Using Prosperity Life’s Final Expense Product

As both an agency owner who recruits and trains final expense agents nationally and as a personal producer since 2011, I am VERY picky with working with solid final expense carriers that make life easy for agents.

My conclusion on Prosperity Life’s final expense plan is that it is one of the most well-balanced carriers to sell your final expense prospects with.

The biggest benefits Prosperity Life brings with its final expense product includes: agent ease of use and well-balanced underwriting/pricing.

Ease Of Use

One thing is for sure. Prosperity Life final expense has done an excellent job making it easy to do your final expense business with them.

Regardless of how you prefer to submit applications – paper, e-app, or telephonic app – Prosperity Life will take them (tele-apps not available in certain states).

However, if you elect to use an e-app when you sell face-to-face, there are even more benefits.

-

- You may receive an IMMEDIATE underwriting decision on your e-app once you submit it, WITHOUT a phone call. This means you can leave your client’s home KNOWING the policy has been issued.

-

- Additionally, e-apps DRAMATICALLY reduce frustrating amendments and go-backs to clients, ultimately meaning MORE of your business will stick writing with Prosperity Life, and MORE time spent with first-time appointments to close more business.

Overall, Prosperity Life makes it simpler to sell final expense to your prospects.

Between all the resources provided and simplified app writing process, you’ll fare much better writing Prosperity Life’s New Vista final expense product over others.

Well-Balanced Underwriting/Pricing

Another advantage Prosperity Life brings to final expense agents is an overall, well-balanced product with easy-to-understand underwriting combined with a fair pricing model.

When introducing new final expense agents to available carriers, it’s vital to select a core group of carriers that will cover most conditions at reasonable rates.

Ideally, you want one of the core carriers to be your “go-to” carrier that will cover most prospects without price-gouging them.

Prosperity Life’s final expense product easily fits the bill of a “go-to” carrier. The underwriting is more than fair with many advantages you’ll appreciate:

-

- Insulin use is acceptable as Level but Diabetes with complications would be Modified

-

- 2-year look-back on heart events like heart attacks, strokes, etc. (treatment includes taking medication)

-

- Generous allowances on height-weight chart maximums.

-

- A true graded program that gives partial first-day coverage to hard-to-approve conditions like neurological diseases (such as Parkinson’s), kidney (no dialysis)/liver issues like Hepatitis C (advanced Cirrhosis is a knockout), and COPD.

Combine these underwriting advantages with moderately-competitive pricing – AND FULL COMMISSION on ALL products at ALL ages – and you’ve got a winner.

Drawbacks Of Prosperity Life’s Final Expense Product

As with all my final expense carrier review articles, I try to point out a few shortcomings with each product to remain as fair as possible.

No product is perfect for everyone, so it’s important to know circumstances where one would not write Prosperity Life.

Prosperity Life’s willingness to cover mental health disorders is tighter than most.

Prosperity Life final expense product only offers graded coverage to your bi-polar prospects (of which you’ll come across many) and schizophrenics.

Luckily, there are plenty of carriers that will take these conditions as first-day full coverage, so no sweat there.

When it comes to cardiac medication treatment, Prosperity is similar to other carriers in that it is tight on heavy blood thinners like coumadin and warfarin, and heart attack prevention/angina medications like nitroglycerin.

Again, there are carriers that will take these conditions with no issue at level coverage, so no big deal.

Summary

Prosperity Life is a top contender for most well-rounded, go-to carrier for final expense agents.

If you’re looking for an easy-to-use carrier with fair pricing and underwriting, Prosperity Life’s New Vista final expense product should be high on your list of top picks.

Want To Sell Prosperity Life’s Final Expense Product?

To learn more about contracting, reach out here.

We have access to all sorts of benefits for final expense agents, including:

-

- Top contracts for new and experienced agents. David Duford recruits and operates at FMO/IMO levels, giving him buying power to offer commission levels to agents and agencies others cannot match.

-

- Affordably-priced, high-quality lead programs for direct mail, Facebook, and telemarketing leads. David does not profit from the sale of leads, only referring you to sources with a track record of success.

-

- An endless supply of top-notch prospecting and sales training at your fingertips.

-

- Weekly sales training calls with David, ride-along training opportunities with David and his team, and direct phone/text access to David when you have case placement and sales questions (yes, David answers his own phone =).

-

- Additional training and support for agents interested in cross-selling Medicare Advantage, annuities, or growing their own insurance agency.

Reach out to David by starting here. Talk soon!

January 03, 2023

January 03, 2023

January 03, 2023

![Cover - Prosperity Life Final Expense Product Review [For Agents Only]](https://davidduford.com/wp-content/uploads/2023/01/prosperity-life-final-expense-1024x576-1.jpg)