Are you a final expense agent interested in adding Lifeshield National to your final expense insurance companies line-up?

Do you want a “No BS” overview from a field-tested agent on how this company’s final expense product performs?

If so, you have found the right article!

I’ll be discussing at length how Lifeshield’s final expense product stacks up, why final expense agents should consider it, and give you my opinion on its pros and cons as a producing agent selling final expense.

Quick Article Navigation Links

-

- Product Details

-

- Health Questions

-

- Rates

-

- Pros & Cons

-

- Getting Contracted

Overview Of The Lifeshield National Final Expense Product

Application Type: Paper for first app, E-App available Apple devices.

Agent Support Hotline: 1-800-366-8354 ext. 408

Point Of Sale Interview Required? No, but if any MIB discrepancies occur, Underwriting may conduct an phone interview to clarify eligibility with your client.

State Availability: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, DC, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, Wyoming

Paper Application Submission: Upload to your computer and email newbusinessapp@uflic.com, or fax completed apps to 1-580-255-0951

Average Policy Issue Turnaround Time: 3 business days.

Commission Payout: On policy ISSUE!

Can You Sell Over The Phone? No

Advancing Available? Yes, 75% of annual premium if the agent qualifies

How Far In Advance Can The First Draft Be? No more than 30 days after the application was signed.

Frequency Of Commission Payout: Weekly every Wednesday and on the last business day of the month.

Pays Commission On Policy Fee? No

Age Rating: Based on effective date

Chargebacks On Death: If policy is contested within first 2 years and checks out, it’s a charge back on unearned advance. If policy is rescinded, it’s a full charge back.

Chargebacks On Lapses: Any unearned advance

Underwriting Overview: MIB only (No RX check or prescription drug guidelines! Eligibility based COMPLETELY on the application’s health questions.

Agent Guide: Download here

Requires E&O? Yes

Acceptable Payment Methods? Bank draft only

Face Amount Issue Limits For The Golden Eagle Plan

-

- Standard Or Graded Issue:

-

- 45 to 85: $3,500 to $30,000

-

- Standard Or Graded Issue:

Available Riders: None

Cover Foreign Nationals? No

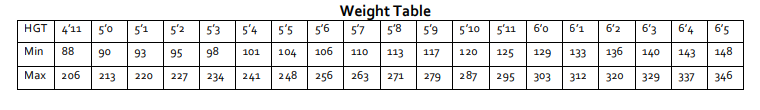

Height-Weight Chart? Included in the sample final expense application below

Sample Final Expense Application: Download here

Rate Guide: Download here for per-thousand rates; scroll down to see actual rates and sample face amounts.

Prescription/Rx Guide: Does NOT use Rx’s to determine eligibility, only whether or not the client can answer “yes” to the application’s health questions.

Underwriting Advantages:

-

- Typically top 3 LOWEST PRICED final expense carriers on the market, especially for male smokers and non-smokers, and female smokers.

-

- No point of sale interview required! Just write and roll!

-

- Higher renewals on average than other carriers.

-

- No RX guidelines. Lifeshield determines eligibility on the ability of the client to answer “no” to each question.

-

- Depression and bi-polar considered for Standard pricing.

-

- Non-insulin diabetics WITHOUT complications of diabetes considered for Standard pricing.

-

- 2-year look back on MOST cardiac events and procedures to be considered for Standard pricing.

Lifeshield National Final Expense Application Questions

What follows below is a list of Lifeshield’s Standard and Graded final expense product’s health-qualifying questions your prospect will need to answer in order to potentially qualify for coverage.

To review the application health questions for yourself, you can download a sample final expense application here.

If any questions in Section A below is answered “yes,” the applicant is not eligible for any coverage:

1. Is the Proposed Insured currently a resident of a nursing home or skilled nursing facility; a patient in a hospital or psychiatric facility; confined to a correctional facility, receiving or been advised by a member of the medical professional to receive skilled nursing care, hospice care, or home health care within the past 5 years?

2. Has the Proposed Insured ever been diagnosed or treated by a member of the medical profession for (including prescription medications) congestive heart failure, peripheral neuropathy, epilepsy, schizophrenia, ALS (Lou Gehrig’s disease), or does the Proposed Insured have a cardiac defibrillator?

3. Has the Proposed Insured ever been diagnosed by a member of the medical profession with an unoperated aneurysm?

4. Has the Proposed Insured ever been diagnosed or treated by a member of the medical profession for Alzheimer’s disease or dementia or been prescribed Aricept, Cognex, Donepezil, Exelon, Razadyne, or Namenda?

5. Has the Proposed Insured ever been diagnosed or treated by a member of the medical profession for Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC), or tested positive for the Human Immunodeficiency Virus (HIV)?

6. Does the Proposed Insured use a wheelchair, or does the Proposed Insured require assistance (from anyone) with Activities of Daily Living: bathing, dressing, eating, toileting, walking, moving about, getting in or out of bed or chairs or taking medication?

7. Has the Proposed Insured ever been diagnosed or treated by a member of the medical profession for internal cancer or melanoma?

8. Has the Proposed Insured ever been diagnosed,treated for (including prescription medications), or advised to receive treatment by a member of the medical profession for Parkinson’s disease, multiple sclerosis, lupus, liver failure, Hepatitis C, cirrhosis of the liver, or kidney disease requiring dialysis?

9. Has the Proposed Insured ever had or been advised by a member of the medical profession to have an organ transplant or bone marrow transplant?

10. Has the Proposed Insured been diagnosed or treated by a member of the medical profession for diabetes and use or been advised by a member of the medical profession to use insulin; or has the Proposed Insured ever had an amputation due to diabetes or other disease?

11. Within the past 24 months, has the Proposed Insured had any diagnostic testing excluding those related to the Human Immunodeficiency Virus (AIDS virus) or any medical procedure recommended by a member of the medical profession that hasn’t been completed, or test results excluding those related to the Human Immunodeficiency Virus (AIDS virus) the Proposed Insured hasn’t yet received?

12. Within the past 12 months, has the Proposed Insured been diagnosed, hospitalized, treated or advised by a member of the medical profession to have treatment for (including prescription medications): heart attack, stroke or Transient Ischemic Attack (TIA), aneurysm, angina pectoris, any cardiovascular surgery, or has the Proposed Insured been advised by a member of the medical profession to have an implanted pacemaker?

13. Within the past 12 months, has the Proposed Insured used or been advised by a member of the medical profession to use OXYGEN in connection with treatment for Chronic Obstructive Pulmonary Disease (COPD), Chronic bronchitis, emphysema, asthma or other lung disease?

14. Within the past 12 months, has the Proposed Insured been treated for or advised by a member of the medical profession to receive treatment for alcohol or drug use?

15. Is the Proposed Insured under age 65 AND receiving social security disability benefits?

16. Within the past 12 months, has the Proposed Insured CHEWED TOBACCO, or SMOKED AND been diagnosed, treated (including prescription medications) or advised by a member of the medical profession to have treatment for Heart Disease, Chronic Obstructive Pulmonary Disease (COPD), Chronic bronchitis, emphysema, asthma or other lung disease?

17. Does your weight fall outside the guidelines for your height on the Weight Table below?

If all questions in Section A are answered “NO”, and any question in Section B (listed below) is answered “Yes”, the Proposed Insured is only eligible for the Graded Death Benefit.

1. Within the past 24 months was the Proposed Insured diagnosed, treated for, or advised by a member of the medical profession to receive treatment for heart attack, stroke, Transient Ischemic Attack (TIA), aneurysm, angina pectoris, or any cardiovascular surgery? surgery?

2. Within the past 24 months were you diagnosed, treated for (including prescription medications and inhalers), or advised to receive treatment by a member of the medical profession for Chronic bronchitis, emphysema, asthma, Chronic Obstructive Pulmonary Disease (COPD), or any other lung disease or disorder?

3. Within the past 24 months was the Proposed Insured diagnosed, treated for, or advised by a member of the medical profession to receive treatment for liver disorder or kidney disease without dialysis?

4. Within the past 24 months has the Proposed Insured had or been advised by a member of the medical profession to receive treatment for alcohol and/or drug use?

5. Within the past 24 months did the Proposed Insured receive treatment by a member of the medical profession or have a surgery for an aneurysm?

6. Does the Proposed Insured have a pacemaker that was implanted more than 12 months prior to the date of the application?

If all questions in sections A and B are answered “No”, the proposed insured qualifies for the Survivor Level Benefit Plan.

Lifeshield Final Expense Rates

Below you’ll find a $10,000 coverage rate chart for males and females (non-smoking and smoker) for the first-day full coverage program only.

Want more or less than $10,000 in coverage for your client, or want to see Graded rates? You can run those specific prices by downloading the rate guide here.

[table id=5 /]

[table id=6 /]

My Thoughts On Using Lifeshield’s Final Expense Product As A Producing Agent

In short, Lifeshield is a useful low-price leader that final expense agents everywhere can readily use in many circumstances.

Below is a list of the top reasons why I would consider writing Lifeshield’s final expense product:

-

- Price-Buster: If I have an applicant with overpriced coverage or who has great health and wants to get the best bang for her buck, Lifeshield delivers. They offer some of the lowest premiums in the business. Once approved, the likelihood is small that you’ll ever get replaced by another agent. This means stickier business and happier clients.

-

- First-To-Die Concept: Lifeshield is one of a handful of carriers that offer a first-to-die policy where both husband and wife are covered, and the first spouse to pass away is the only time the benefit is paid. This can be useful in circumstances where the death of one spouse may have a more immediate financial need than the last spouse passing away, and convert prospects into clients.

-

- No Phone Interview: As long as your client can answer all questions no, they are eligible for the Standard, low-rate pricing without a point of sale interview. However, if there is discrepancies in the applicant’s health history, the company reserves the right to interview the client briefly to clarify in order to confirm whether or not coverage is available.

Drawbacks

As with most low-price leader final expense carriers, the better the pricing, the tougher the underwriting.

Lifeshield has pretty tough underwriting standards that many of your final expense prospects will not qualify for.

Anyone receiving disability under 65 is not eligible for coverage.

If your client has ever had cancer or has taken insulin, he’s not eligible, either.

The e-app, while useful to have, is only available for Apple devices. Plus it does not offer an instant decision upon submission.

Conclusion

Overall, Lifeshield is a niche-player in the final expense world.

It’s unlikely you’ll write a majority of your business with them.

However, Lifeshield’s final expense product can play an important roll in getting some of the lowest premium rates for your healthiest clientele, whether you are writing their first policy, or replacing existing coverage.

As a final expense field agent since 2011, I can’t stress enough the importance to ensure your clients get the most competitive pricing when available.

There is more competition in the final expense business now than there ever was, and offering a product like Lifeshield when sensible to lock in a competitive rate is always a smart play to increase your odds of keeping your client on the books for years, and reducing the chances of another agent coming in later to replace you.

Want To Sell Lifeshield’s Final Expense Product?

To learn more about contracting, reach out here.

We have access to all sorts of benefits for final expense agents, including:

-

- Top contracts for new and experienced agents. David Duford recruits and operates at FMO/IMO levels, giving him buying power to offer commission levels to agents and agencies others cannot match.

-

- Affordably-priced, high-quality final expense lead programs for direct mail, Facebook, and telemarketing leads. David does not profit from the sale of leads, only referring you to sources with a track record of success.

-

- An endless supply of top-notch prospecting and sales training at your fingertips.

-

- Weekly sales training calls with David, ride-along training opportunities with David and his team, and direct phone/text access to David when you have case placement and sales questions (yes, David answers his own phone =).

-

- Additional training and support for agents interested in cross-selling Medicare Advantage, annuities, or growing their own insurance agency.

Reach out to David by starting here. Talk soon!

January 03, 2023

January 03, 2023

January 03, 2023

![Cover - Lifeshield Final Expense Product Review [For Agents Only]](https://davidduford.com/wp-content/uploads/2023/01/lifeshield-final-expense-1024x576-1.jpg)