Are you a final expense agent interested in adding Trinity Life Insurance Company / Family Benefit Life to your final expense insurance companies line-up?

Do you want a “No BS” overview from a field-tested agent on how this company’s final expense product performs?

If so, you have found the right article!

I’ll be discussing at length how Trinity Life / Family Benefit Life’s final expense product stacks up and why final expense agents should pick it up.

I’ll also give you my opinion on its pros and cons as a producing agent selling final expense.

NOTE 1: Trinity Life and Family Benefit Life Insurance Company are the same company. They operate under different names depending on the state you’re in, but follow the same underwriting and pricing guidelines. So, whenever I reference one company, understand that always refers to BOTH Trinity Life and Family Benefit.

NOTE 2: If you are a consumer looking for information on buying a Trinity Life final expense plan, you can learn more about the company and product here.

Quick Article Navigation Links

Overview Of The Trinity Life Family Benefit Final Expense Product

Application Type: Paper with point of sale interview, -or- a paperless, telephonic application

Agent Support Hotline: (866) 211-0811

Point Of Sale Interview Required? Yes

State Availability: Available in ALL the following states: Trinity Life Insurance Company – IL, KS, KY, NE, ND, OH, OK, TX – Family Benefit Life – AZ, AR, CO, GA, IN, LA, MO, NC, NM, PA, SD, TN, WV, UT, AL, MS, VA, MI – Complete availability map here.

Paper Application Submission: Upload to agent portal, fax in, or telephonic submission if doing the telesales app.

Average Policy Issue Turnaround Time: 24-48 hours

Commission Payout: Half of your advance on issue, the other half on first draft.

Can You Sell Over The Phone? No

Advancing Available? Yes – 9 months advance for those that qualify. Debit/Credit/Direct Express paid as-earned.

How Far In Advance Can The First Draft Be? Within 45 days of the policy’s effective date.

Frequency Of Commission Payout: Tuesdays and Thursdays

Pays Commission On Policy Fee? Yes

Age Rating: Age based on effective date, *not* application date

Chargebacks On Death: Only if rescinded

Chargebacks On Lapses: Chargeback on unearned commission

Underwriting Overview: MIB and Rx check

Agent Guide: Download here

Requires E&O? No

Acceptable Payment Methods? Bank account, Direct Express, or Debit/Credit Card (Visa, MasterCard). Non bank account draft policies must account for less than 20% of your block of business.

Face Amount Issue Limits For The Golden Eagle Plan

-

- Simplified Issue (level coverage):

-

- 50-85: $2,500 to $25,000

-

- Simplified Issue (level coverage):

-

- Graded Benefit

-

- 50-80: $2,000 to $10,000

-

- Graded Benefit

Available Riders: Accelerated death benefit rider added at no additional cost.

Cover Foreign Nationals? Must be permanent US resident

Height-Weight Chart? Download here

Sample Final Expense Application: Download here

Rate Guide: Download here

Prescription/Rx Guide: Download here

Underwriting Advantages:

-

- Very competitive rates! Easily in the top 10% most competitively-priced final expense carriers.

-

- Great underwriting, too. Accepts a host of sometimes hard-to-cover conditions for level coverage, like insulin starting after 40 years old, diabetic neuropathy (NOTE: Company WILL closely monitor your insulin-submitted business to make sure it stays at an acceptable thresh hold – they are very aware of their underwriting advantages, but want to balance them out with healthier clients), and has a short 2-year look back on most cardiac and cancer health events.

-

- Social Security deposit drafting option times your drafts exactly to the client’s monthly Social Security check deposit date, reducing lapses and missed payments.

-

- Telephonic application option (paper apps still available if you’re a dinosaur like me) makes application submission a breeze. No frustrating amendments or paperwork necessary! Get an instant decision within 15 minutes!

-

- 5% lead bonus you can use with ANY final expense lead vendor when you issue 5000AP within a calendar month on total production. More information on how that works here.

-

- Overall, my personal favorite carrier to start new agents with for their less sickly prospects.

Family Benefit / Trinity Life Insurance Company Final Expense Application Questions

What follows below is a list of Trinity Life’s Golden Eagle final expense product’s health-qualifying questions your prospect will need to answer in order to potentially qualify for coverage.

To review the application health questions for yourself, you can download a sample final expense application here.

How The Golden Eagle Plan Works

Family Benefit Life final expense offers 2 rate classes for its Golden Eagle program:

-

- Simplified Issue (level coverage). This is day 1, 100% face amount coverage for natural and accidental causes of death.

-

- Graded Death Benefit (partial coverage). The Graded Death Benefit plan provides partial coverage for the first 2 years. I rarely use it and know that few agents ever write it. Since it’s not an often-used product, I won’t spend time discussing it. You can review how it works in more detail here.

Knockout Questions

If any question below is answered “yes,” then the client is not eligible for the the simplified issue level Golden Eagle product or Graded product:

11. Have you ever received or been given medical advice by a medical professional you need to receive an organ or tissue transplant?

12. Have you been diagnosed or treated by a member of the medical profession as having: AIDS (Acquired Immune Deficiency Syndrome), ARC (AIDS Related Complex), or HIV (Human Immunodeficiency Virus) virus?

13. Have you ever been diagnosed with congestive heart failure, cardiomyopathy or a life expectancy of 24 months or less?

14. Have you ever been diagnosed with, treated for or taken medication for: dementia, Alzheimer’s disease, mental incapacity, Downs Syndrome, Huntington’s disease, Lou Gehrig’s Disease (ALS), cystic fibrosis, cerebral palsy, muscular dystrophy, or sickle cell anemia?

15. Are you currently, or within the past 6 months have you been: hospitalized, bedridden, used oxygen to assist in breathing, confined to a wheelchair, nursing home, hospice, received home health care or been on dialysis?

16. Within the past 12 months have you been diagnosed as having, or been hospitalized for: heart attack, stroke, transient ischemic attack (TIA), angina, aneurysm, or had cardiac or circulatory surgery of any kind to improve circulation to the heart or brain?

17. Within the past 12 months have you been: hospitalized two or more times, or been advised by a medical professional to have surgery, hospital confinement, or nursing facility confinement and have not done so?

18. Within the past 24 months have you been diagnosed as having, treated by a medical professional for or taken medication for: internal cancer, leukemia, or melanoma?

19. During the past 24 months have you been: advised by a medical professional to have any diagnostic testing recommended, except for an HIV test, which has not been completed, or for which the results have not yet been received, or had or been advised to have treatment or counseling for alcohol or drug abuse.

20. During the past 24 months have you been treated by a medical professional for insulin shock, diabetic coma, amputation caused by disease, or have you ever taken insulin shots prior to age 40?

If the below questions are answered “yes,” the client will only be considered for the Graded product. Answering “no” to all questions allows your client to be considered for the Level product.

21. During the past 24 months have you begun prescribed medication for, been hospitalized for, or been diagnosed as having: kidney insufficiency or failure, heart attack, stroke, transient ischemic attack (TIA), angina, aneurysm, or had cardiac or circulatory surgery of any kind to improve circulation to the heart or brain?

22. Have you ever been diagnosed as having: multiple sclerosis, epilepsy, Parkinson’s, systemic lupus, cirrhosis of the liver, liver disease, liver failure, hepatitis B or C or lung impairments (including chronic obstructive pulmonary disease (COPD), chronic asthma, chronic bronchitis, emphysema or fibrosis)?

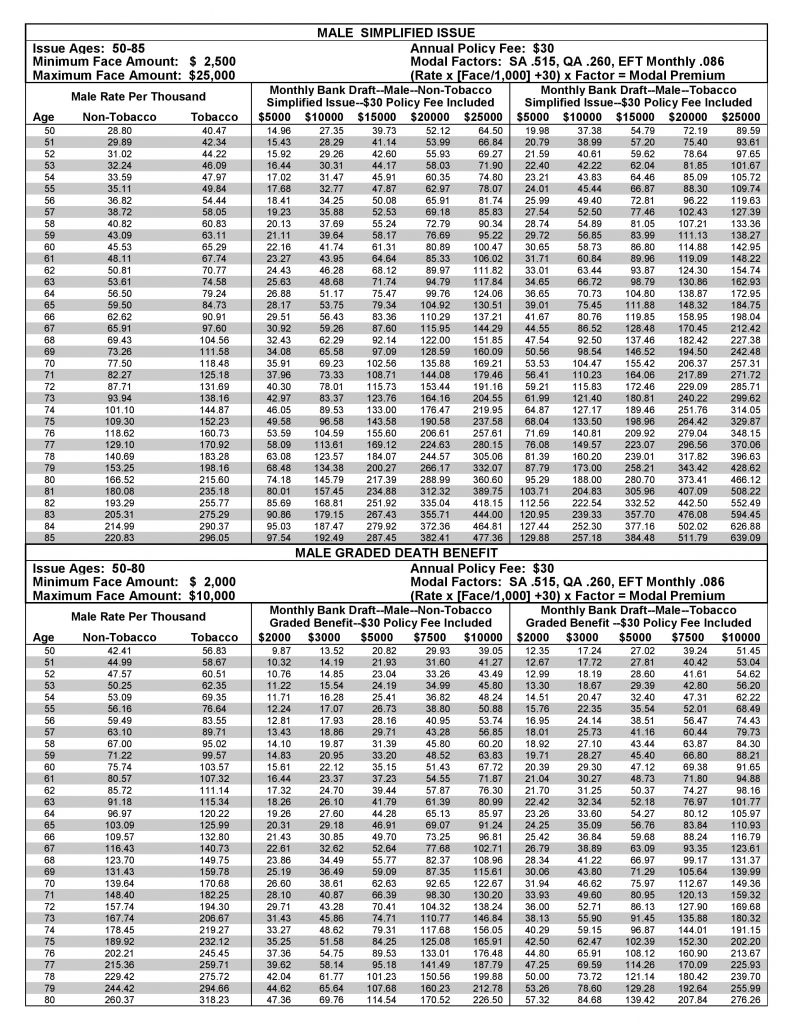

Trinity Life Family Benefit Rate Guide

Below you’ll find 2 rate charts for males and females (non-smoking and smoker) for both the Simplified Issue and Graded Benefit program.

If you’d prefer to download the rate guide, you can do so here.

NOTE: Rates for Direct Express drafts are the same as bank drafts, but paid on an as-earned basis.

My Thoughts On Using Family Benefit Trinity Life For My Final Expense Prospects

I have been licensed since 2011 and have exclusively sold final expense for that entire period of time.

I have ample experience with dozens of carriers, and have seen many come and go.

Trinity Life Insurance Company remains my favorite first-choice final expense carrier.

They offer such incredible value to the agent that I’m hard-pressed to pass on showing a new or experienced final expense agent how well the product works.

As an independent brokerage and national recruiter of final expense agents since 2013, I run my final expense business in such a way that I want my clients and agents to have access to extremely-competitive products, while making the process as simplified as possible for the agent to write the business.

In this regard, Family Benefit Life final expense is unmatched.

When you compare rates with other final expense carriers, Family Benefit handily beats 90% of the offerings.

Plus, you can get WAY more clients approved for the most competitively-priced plan with the flexibility on insulin use, diabetic neuropathy, and short look-back periods for cardiac and cancer events.

Just make sure not to overload your insulin-dependent clients with Trinity/Family Benefit, as they closely monitor those clients and want you submitting healthy clients, too.

As a manager, I love that Trinity Life offers both point of sale interviews for my agents to know before they leave if the policy has been approved.

I also love access to paperless, telephonic applications to eliminate annoying 2nd appointments to fill in a missed signature or date.

Drawbacks

If there are any drawbacks to Trinity Life Family Benefit Insurance, it is the lack of an e-application process.

Lots of agents request this option now, and more will continue to do so.

Having said that, the telephonic application is just as good, provides a decision at the end of the phone call.

This process eliminates amendments, go-backs, just as well as an e-application would.

Also, don’t load up your Direct Express business with Trinity.

They want no more than 20% of your block from Direct Express and reloadable debit card clientele.

And I don’t blame them.

Both these forms of payment have higher lapse issues and isn’t as profitable as normal bank draft business to the company.

Want To Sell Trinity Life Family Benefit’s Final Expense Product?

To learn more about contracting, reach out here.

We have access to all sorts of benefits for final expense agents, including:

-

- Top contracts for new and experienced agents. David Duford recruits and operates at FMO/IMO levels, giving him buying power to offer commission levels to agents and agencies others cannot match.

-

- Affordably-priced, high-quality lead programs for direct mail, Facebook, and telemarketing leads. David does not profit from the sale of leads, only referring you to sources with a track record of success.

-

- An endless supply of top-notch prospecting and sales training at your fingertips.

-

- Weekly sales training calls with David, ride-along training opportunities with David and his team, and direct phone/text access to David when you have case placement and sales questions (yes, David answers his own phone =).

-

- Additional training and support for agents interested in cross-selling Medicare Advantage, annuities, or growing their own insurance agency.

Reach out to David by starting here. Talk soon!

January 03, 2023

January 03, 2023

January 03, 2023

![Cover - Trinity Life / Family Benefit Life Final Expense Review [For Agents Only]](https://davidduford.com/wp-content/uploads/2023/01/trinity-life-family-benefit-final-expense-1024x576-1.jpg)